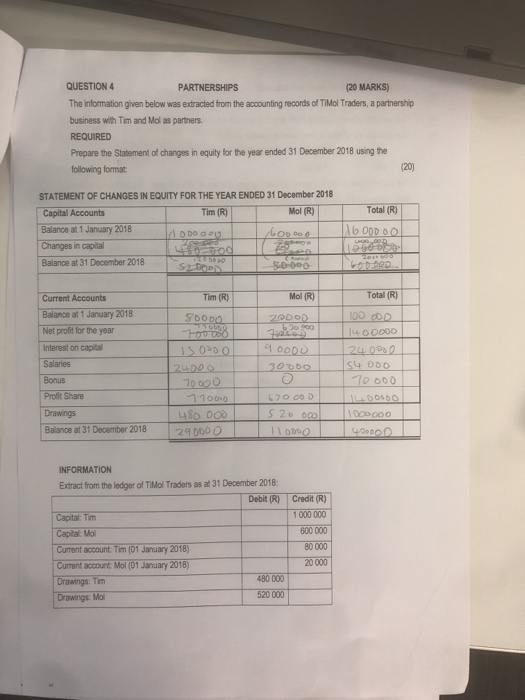

Question: QUESTION 4 PARTNERSHIPS (20 MARKS) The information given below was extracted from the accounting records of TiMol Traders, a partnership business with Tim and Molas

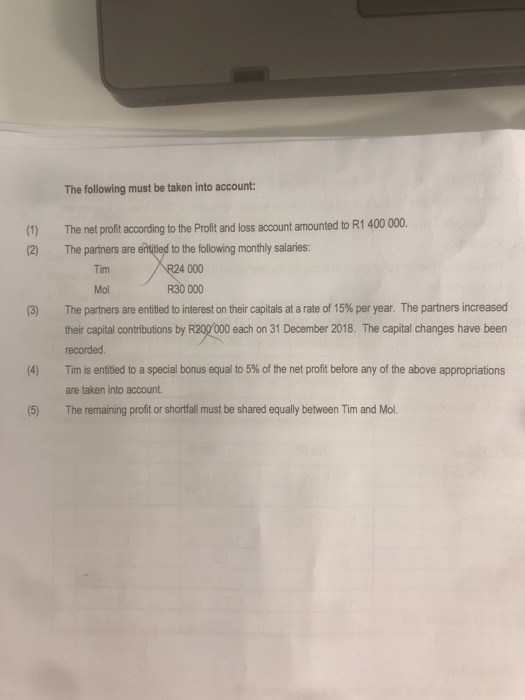

QUESTION 4 PARTNERSHIPS (20 MARKS) The information given below was extracted from the accounting records of TiMol Traders, a partnership business with Tim and Molas partners. REQUIRED Prepare the Statement of changes in equity for the year ended 31 December 2018 using the following format (20) STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 December 2018 Capital Accounts Tim (R) Mol (R) Balance at 1 January 2018 DOO booooo Changes in capital Balance at 31 December 2018 $0 000 Total (R) 16 ODDOO Tim (R) Mol(R) 50000 20DOD Current Accounts Balance at 1 January 2018 Net profit for the year Interest on capital Salaries Bonus Profit Share Drawings Balance at 31 December 2018 Total (R) 100 DD 140 DOOD | 240000 S4ooo Toooo qoooo Soooo 24DOO 77000 480oo0 290000 o 670000 S 20 oool 110 1OOOOO 0 D INFORMATION Extract from the ledger of Tol Traders as at 31 December 2018: Debit (R) Capital Tim Capital Mai Current account. Tim (01 January 2018) Current account. Mol (01 January 2018) Drawings: Tim 480 000 Drawings Mai 520 000 Credit (R) 1 000 000 600 000 80 000 20 000 The following must be taken into account: (1) (2) Mol (3) The net profit according to the Profit and loss account amounted to R1 400 000 The partners are entitled to the following monthly salaries: Tim R24 000 R30 000 The partners are entitled to interest on their capitals at a rate of 15% per year. The partners increased their capital contributions by R200 000 each on 31 December 2018. The capital changes have been recorded Tim is entitled to a special bonus equal to 5% of the net profit before any of the above appropriations are taken into account The remaining profit or shortfall must be shared equally between Tim and Mol

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts