Question: Question 4: (Parts A & B - 10 Marks each) (Total 20 Marks) Question 4-A Prepare cash receipts schedule and calculate total cash receipts for

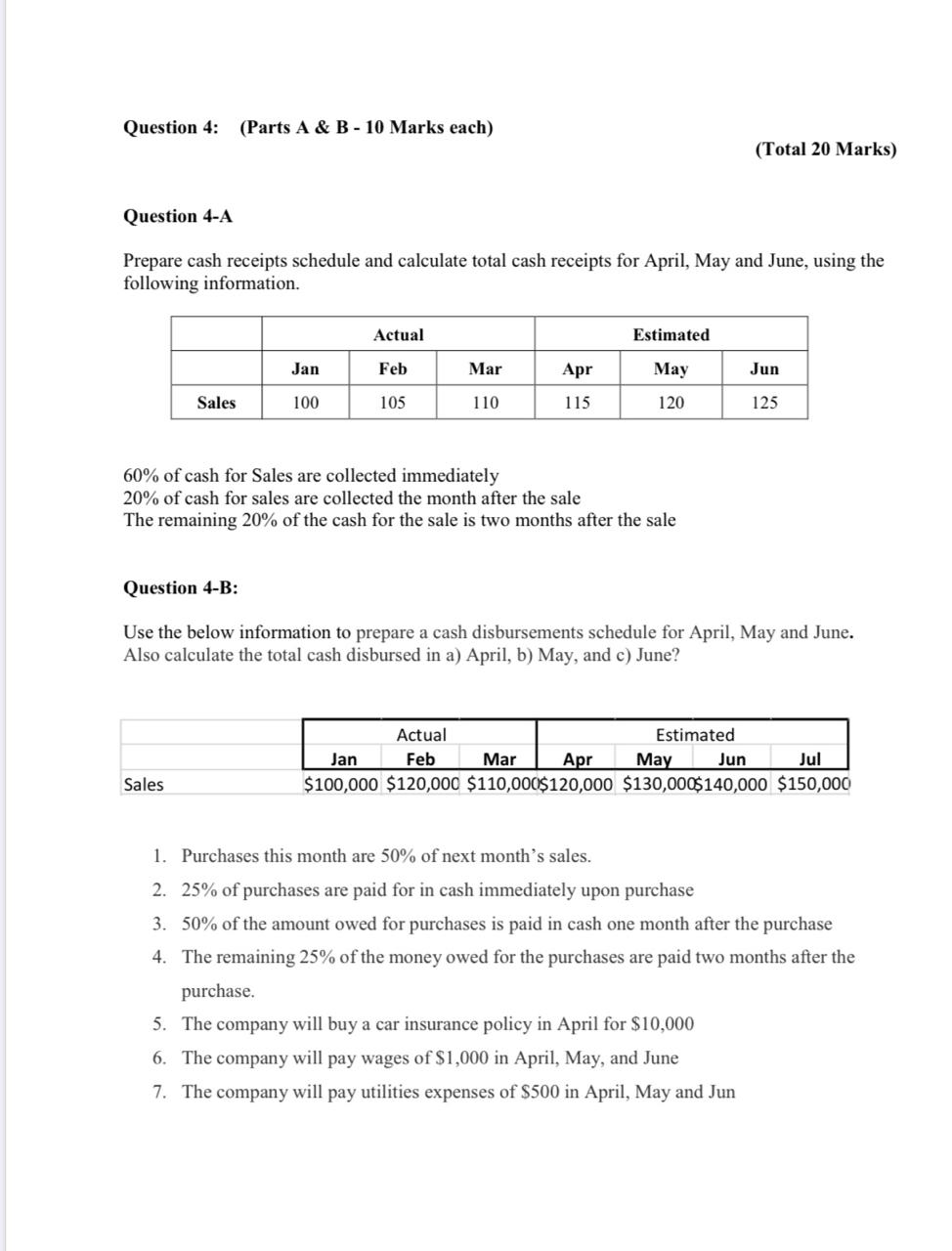

Question 4: (Parts A & B - 10 Marks each) (Total 20 Marks) Question 4-A Prepare cash receipts schedule and calculate total cash receipts for April, May and June, using the following information. Estimated Jan Actual Feb 105 Mar 110 Apr 115 May 120 Jun 125 Sales 100 60% of cash for Sales are collected immediately 20% of cash for sales are collected the month after the sale The remaining 20% of the cash for the sale is two months after the sale Question 4-B: Use the below information to prepare a cash disbursements schedule for April, May and June. Also calculate the total cash disbursed in a) April, b) May, and c) June? Actual Estimated Jan Feb Mar Apr May Jun Jul $100,000 $120,000 $110,000$120,000 $130,000$140,000 $150,000 Sales 1. Purchases this month are 50% of next month's sales. 2. 25% of purchases are paid for in cash immediately upon purchase 3. 50% of the amount owed for purchases is paid in cash one month after the purchase 4. The remaining 25% of the money owed for the purchases are paid two months after the purchase. 5. The company will buy a car insurance policy in April for $10,000 6. The company will pay wages of $1,000 in April, May, and June 7. The company will pay utilities expenses of $500 in April, May and Jun

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts