Question: Question 4 Pension data for Ginobill Bike Services Inc. include the following: Actual return on plan assets, 8% Expected return on plan assets, 6% Discount

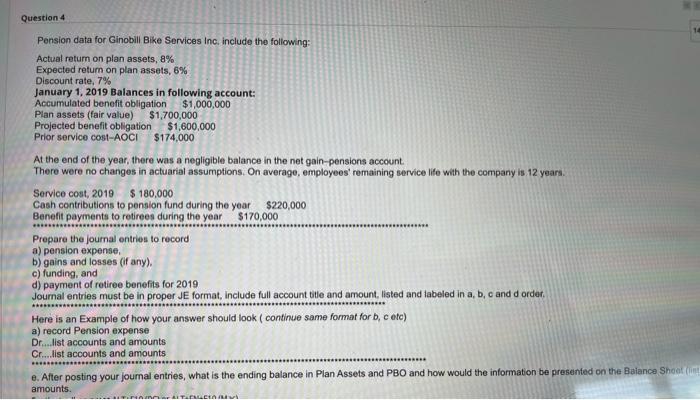

Question 4 Pension data for Ginobill Bike Services Inc. include the following: Actual return on plan assets, 8% Expected return on plan assets, 6% Discount rate, 7% January 1, 2019 Balances in following account: Accumulated benefit obligation $1,000,000 Plan assets (fair value) $1,700,000 Projected benefit obligation $1,600,000 Prior service cost-AOCI $174,000 At the end of the year, there was a negligible balance in the net gain-pensions account There were no changes in actuarial assumptions. On average, employees' remaining service life with the company is 12 years. Service cost, 2019 $ 180,000 Cash contributions to pension fund during the year $220,000 Benefit payments to retirees during the year $170,000 Prepare the journal entries to record a) pension expense, b) gains and losses (if any). c) funding, and d) payment of retiree benefits for 2019 Journal entries must be in proper JE format, include full account title and amount, listed and tabeled in a, b, c and d order Here is an example of how your answer should look ( continue same format for b, c etc) a) record Pension expense Dr....list accounts and amounts Cr...list accounts and amounts e. After posting your journal entries, what is the ending balance in Plan Assets and PBO and how would the information be presented on the Balance Shoot amounts CI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts