Question: QUESTION 4: Pickering Manufacturing Limited (PML) is considering purchasing a widget maker. The widget maker will result in before tax cost savings of $400,000 per

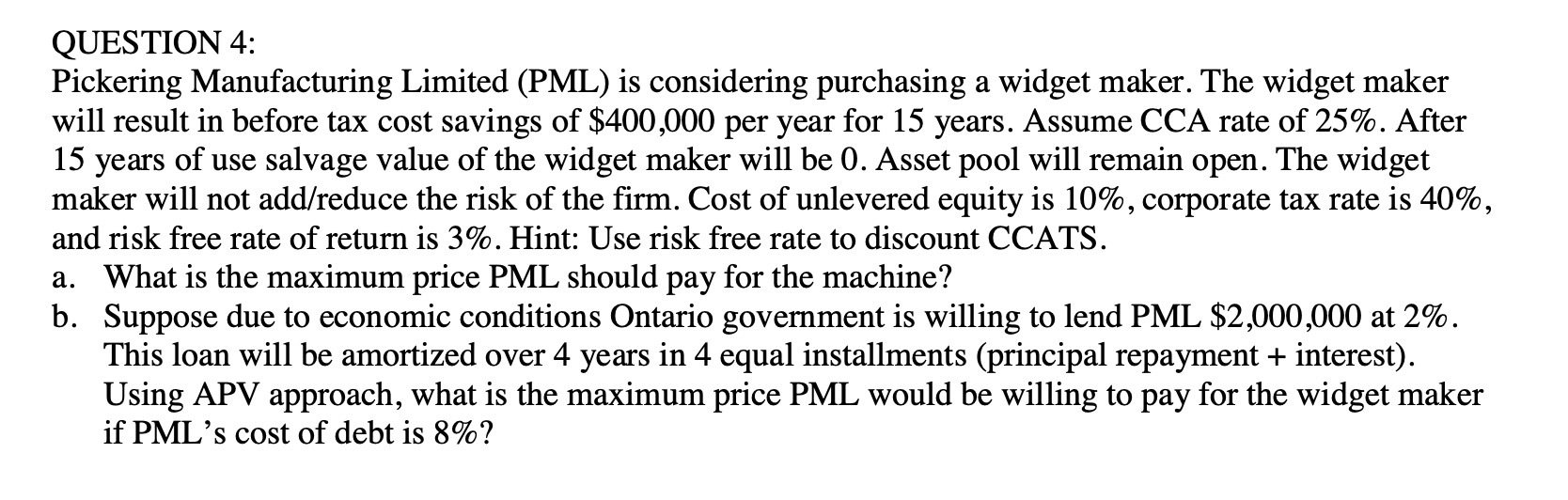

QUESTION 4: Pickering Manufacturing Limited (PML) is considering purchasing a widget maker. The widget maker will result in before tax cost savings of $400,000 per year for 15 years. Assume CCA rate of 25%. After 15 years of use salvage value of the widget maker will be 0. Asset pool will remain open. The widget maker will not add/reduce the risk of the firm. Cost of unlevered equity is 10%, corporate tax rate is 40%, and risk free rate of return is 3%. Hint: Use risk free rate to discount CCATS. a. What is the maximum price PML should pay for the machine? b. Suppose due to economic conditions Ontario government is willing to lend PML $2,000,000 at 2%. This loan will be amortized over 4 years in 4 equal installments (principal repayment + interest). Using APV approach, what is the maximum price PML would be willing to pay for the widget maker if PML's cost of debt is 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts