Question: question 4) pls give excel sheets and boxes in the solutions e) (5 points): The fixed conts for operating our plunt at locations A,B, and

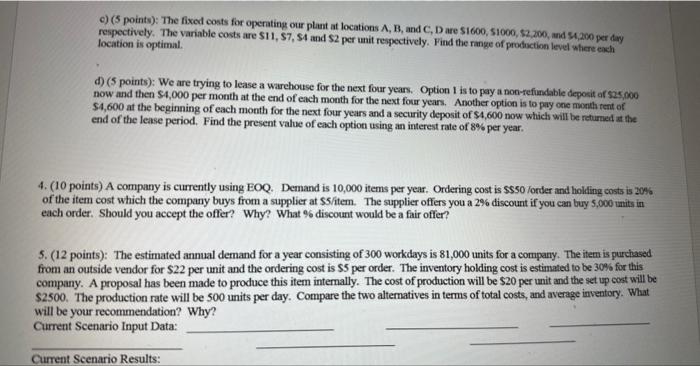

e) (5 points): The fixed conts for operating our plunt at locations A,B, and C,D are 51600,51000,52,200, and 5,200 per day respectively. The variable costs are $11,$7,$4 and $2 per unit respectively. Find the range of production level where each location is optimal. d) (5 points): We are trying to lease a warehouse for the next four years. Option 1 is to pay a non-refundable deposit ar 525,000 now and then $4,000 per month at the end of each month for the next four years. Another option is to pay one month rent of $4,600 at the beginning of each month for the next four years and a security deposit of $4,600 now which will be returned at the end of the lease period. Find the present value of each option using an interest rate of 8% per year. 4. (10 points) A company is currently using EOQ. Demand is 10,000 items per year. Ordering cost is $550 lorder and holding costs is 209 of the item cost which the company buys from a supplier at $5/item. The supplier offers you a 2% discount if you can buy 5,000 units in each order. Should you accept the offer? Why? What % discount would be a fair offer? 5. (12 points): The estimated annual demand for a year consisting of 300 workdays is 81,000 units for a company. The item is purchased from an outside vendor for $22 per unit and the ordering cost is $5 per order. The inventory holding cost is estimated to be 30% for this company. A proposal has been made to produce this item internally. The cost of production will be $20 per unit and the set up cost will be $2500. The production rate will be 500 units per day. Compare the two altematives in terms of total costs, and average inventory. What will be your recommendation? Why? Current Scenario Input Data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts