Question: Question 4 Portfolio Analysis with Three Assets ( 6 points) Consider the expected return and volatility of a portfolio (call it target portfolio) consisting of

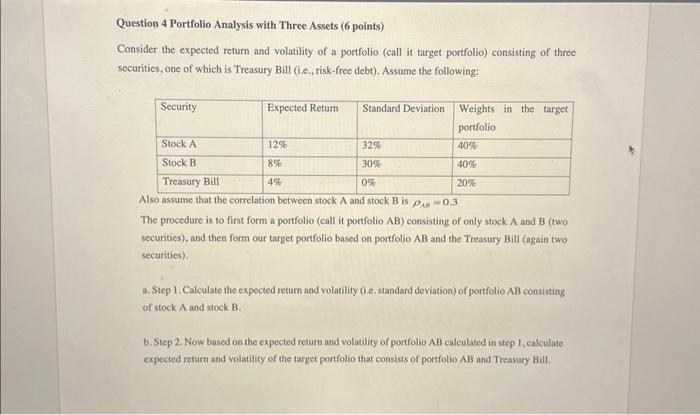

Question 4 Portfolio Analysis with Three Assets ( 6 points) Consider the expected return and volatility of a portfolio (call it target portfolio) consisting of three securities, one of which is Treasury Bill (i.e, risk-free debt). Assume the following: Also assume that the correlation between stock A and stock B is Aw=0.3 The procedure is to first form a portfolio (call it portfolio AB ) consisting of only stock A and B (two securities), and then form our target portfolio based on portfolio AB and the Treasury Bill (again two securitics). a. Step 1. Calculate the expected retum and volatility (i.e. standard deviation) of portfolio AB consisting of stock A and sock B. b. Step 2. Now based on the expected return and volatility of portfolio AB calculated in step 1, calculate expected return and volatility of the target portfolio that consists of portfolio AB and Treasury Bill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts