Question: Question 4 - prepare the consolidated balance sheet on the date of acquisition under the Fair Value Enterprise Method Keen Inc. purchases 80% of

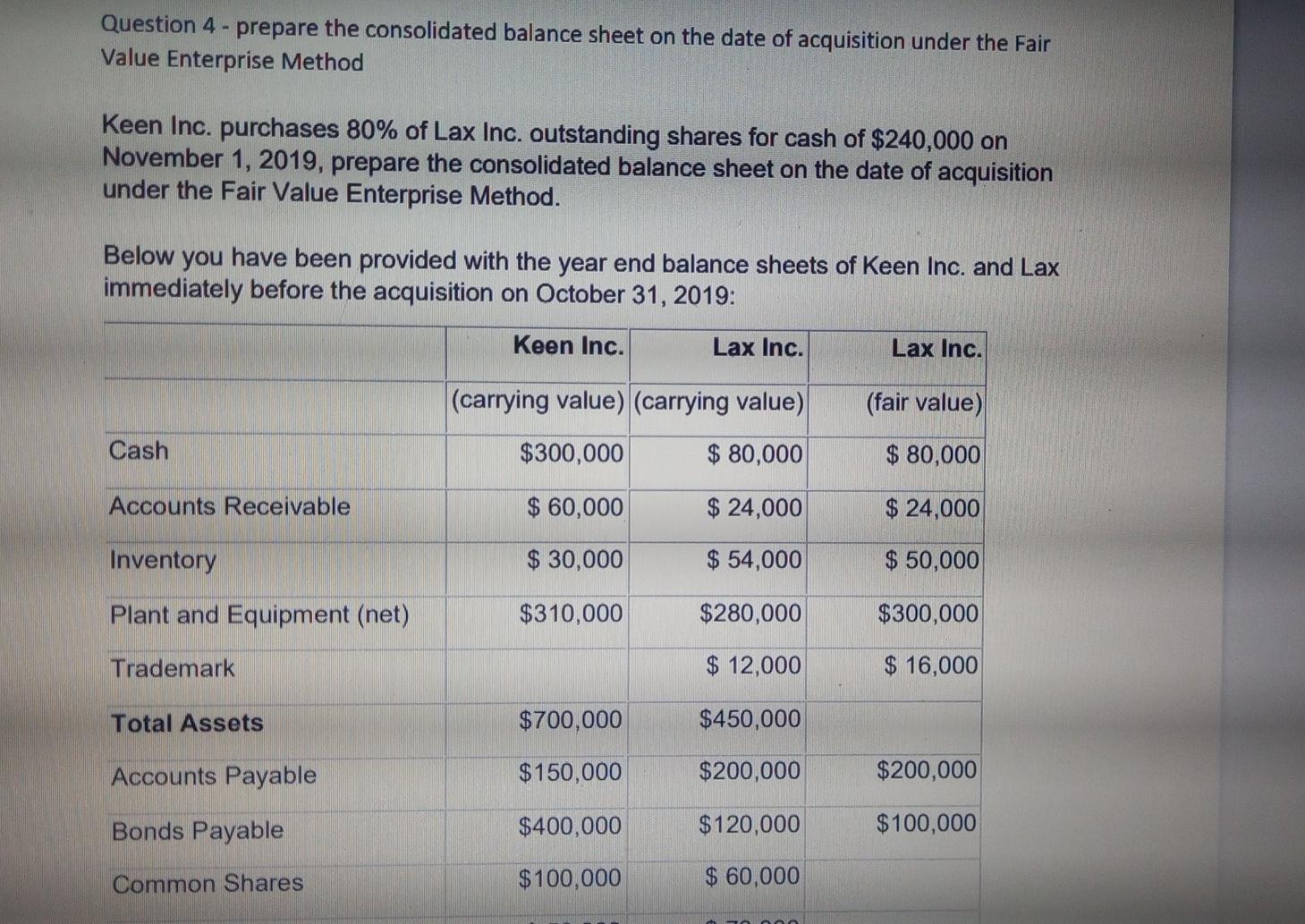

Question 4 - prepare the consolidated balance sheet on the date of acquisition under the Fair Value Enterprise Method Keen Inc. purchases 80% of Lax Inc. outstanding shares for cash of $240,000 on November 1, 2019, prepare the consolidated balance sheet on the date of acquisition under the Fair Value Enterprise Method. Below you have been provided with the year end balance sheets of Keen Inc. and Lax immediately before the acquisition on October 31, 2019: Keen Inc. Lax Inc. Lax Inc. (carrying value) (carrying value) (fair value) Cash $300,000 $ 80,000 $ 80,000 Accounts Receivable $ 60,000 $ 24,000 $ 24,000 Inventory $ 30,000 $ 54,000 $ 50,000 Plant and Equipment (net) $310,000 $280,000 $300,000 Trademark $ 12,000 $ 16,000 Total Assets $700,000 $450,000 Accounts Payable $150,000 $200,000 $200,000 Bonds Payable $400,000 $120,000 $100,000 Common Shares $100,000 $ 60,000 Retained Earnings $ 50,000 $ 70,000 Total Liabilities and Equity $700,000 $450,000 Using the template below prepare the consolidated balance sheet. Keen Inc. Consolidated Balance Sheet as at November 1, 2019

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Consolidated Balance Sheet of Keen Inc as at November 12019 Amounts in Assets Amount Cash Note 2 140... View full answer

Get step-by-step solutions from verified subject matter experts