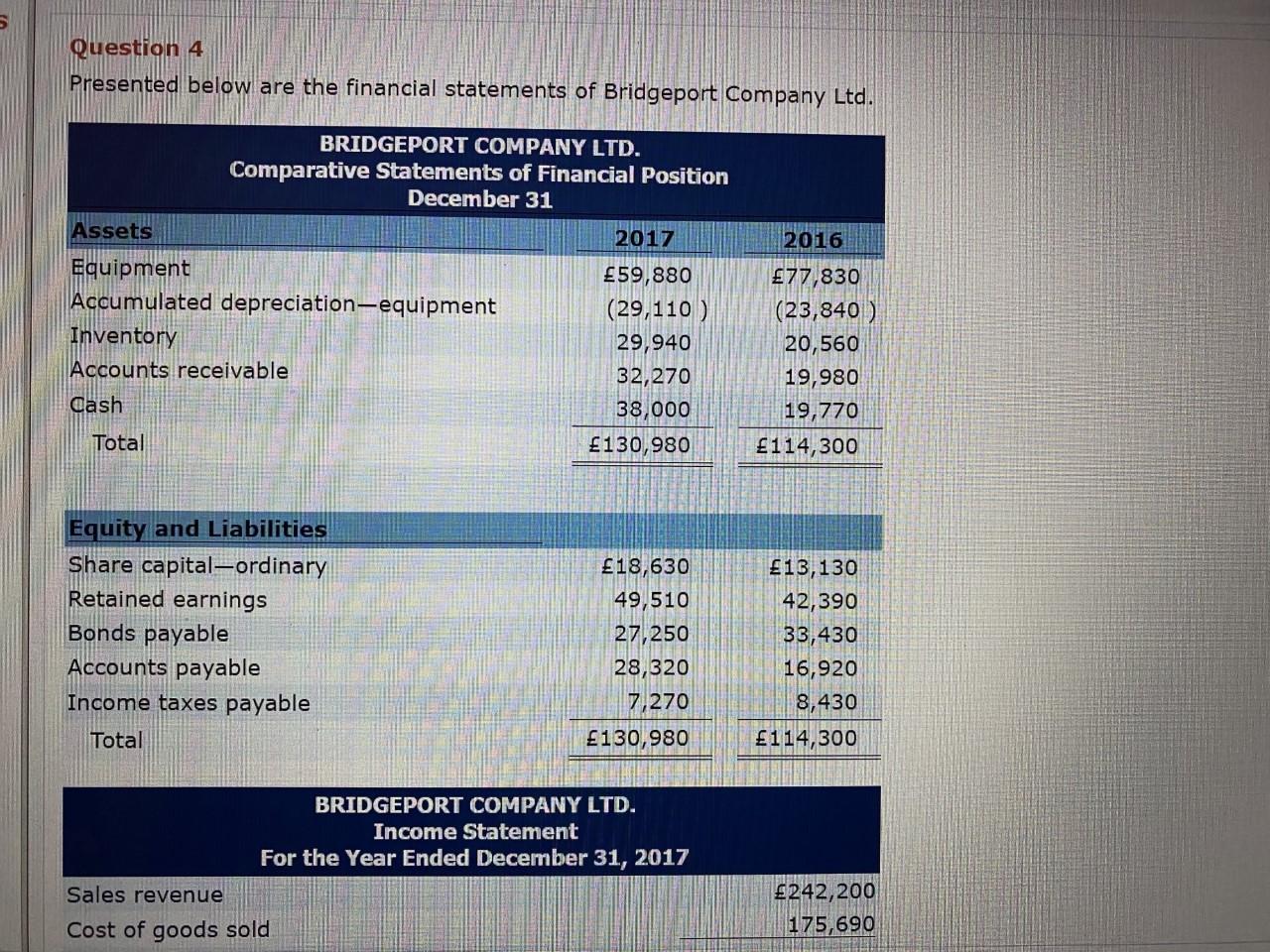

Question: Question 4 Presented below are the financial statements of Bridgeport Company Ltd. BRIDGEPORT COMPANY LTD. Comparative Statements of Financial Position December 31 Assets 2017 2016

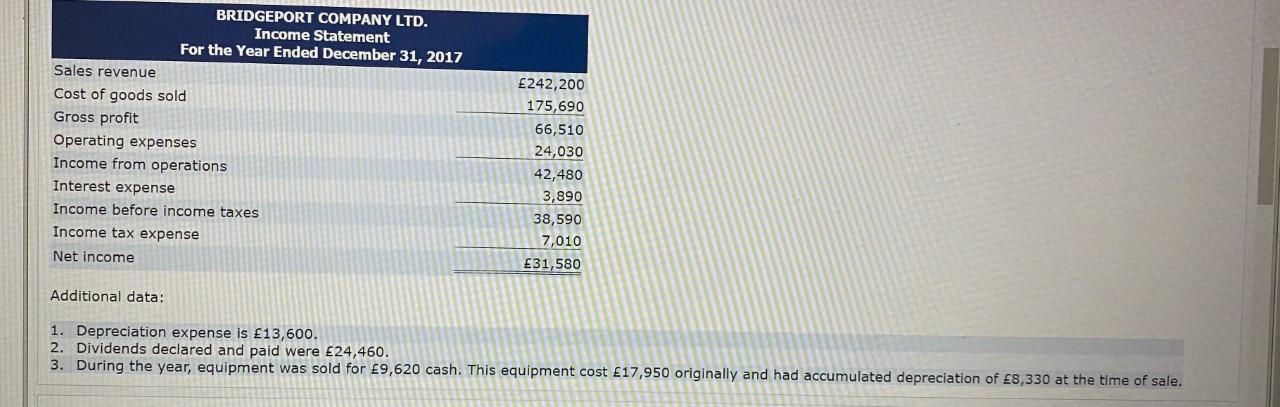

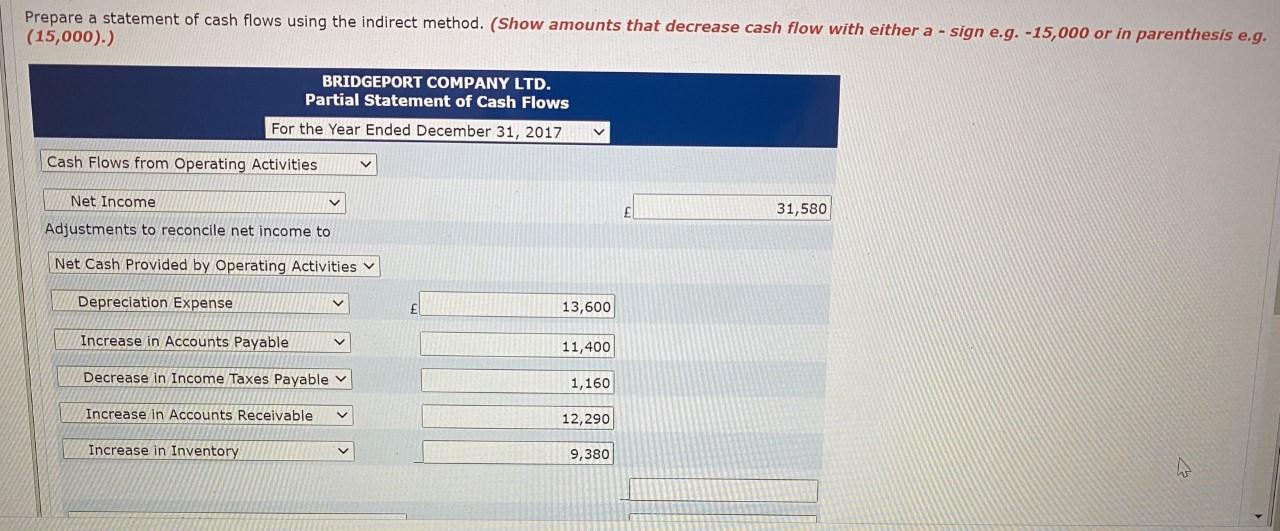

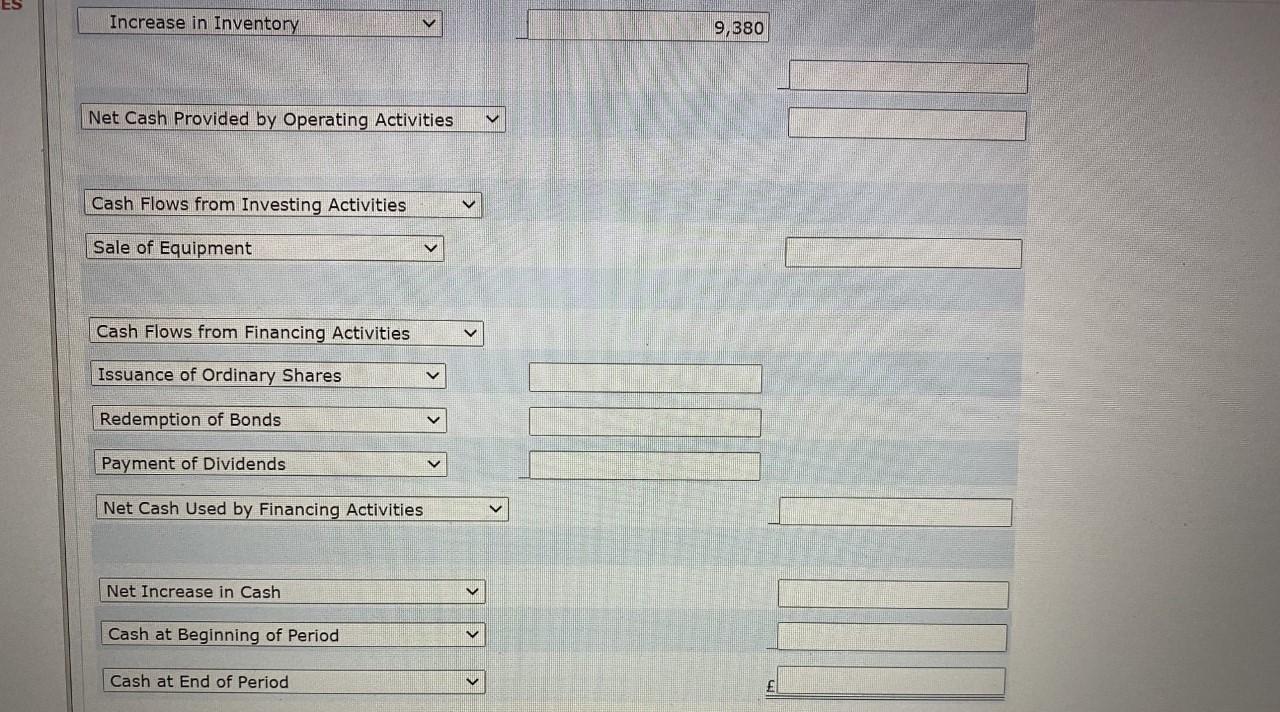

Question 4 Presented below are the financial statements of Bridgeport Company Ltd. BRIDGEPORT COMPANY LTD. Comparative Statements of Financial Position December 31 Assets 2017 2016 Equipment Accumulated depreciation-equipment Inventory Accounts receivable Cash 59,880 (29,110 ) 29,940 32,270 38,000 130,980 77,830 (23,840 ) 20,560 19,980 19,770 114,300 Total Equity and Liabilities Share capital-ordinary Retained earnings Bonds payable Accounts payable Income taxes payable 18,630 49,510 27,250 28,320 7,270 130,980 13,130 42,390 33,430 16,920 8,430 114,300 Total BRIDGEPORT COMPANY LTD. Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of goods sold 242,200 175,690 BRIDGEPORT COMPANY LTD. Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income taxes Income tax expense Net income 242,200 175,690 66,510 24,030 42,480 3,890 38,590 7,010 31,580 Additional data: 1. Depreciation expense is 13,600. 2. Dividends declared and paid were 24,460. 3. During the year, equipment was sold for 9,620 cash. This equipment cost 17,950 originally and had accumulated depreciation of 8,330 at the time of sale. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) BRIDGEPORT COMPANY LTD. Partial Statement of Cash Flows For the Year Ended December 31, 2017 V Cash Flows from Operating Activities V Net Income 31,580 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense 13,600 Increase in Accounts Payable V 11,400 Decrease in Income Taxes Payable 1,160 Increase in Accounts Receivable 12,290 Increase in Inventory 9,380 Increase in Inventory 9,380 Net Cash Provided by Operating Activities Cash Flows from Investing Activities Sale of Equipment Cash Flows from Financing Activities Issuance of Ordinary Shares Redemption of Bonds Payment of Dividends Net Cash Used by Financing Activities Net Increase in Cash Cash at Beginning of Period Cash at End of Period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts