Question: QUESTION 4 Problem 2.3 (b) AT-bill with face value $10,000 and 94 days to maturity is selling at a bank discount ask yield of 4.1%.

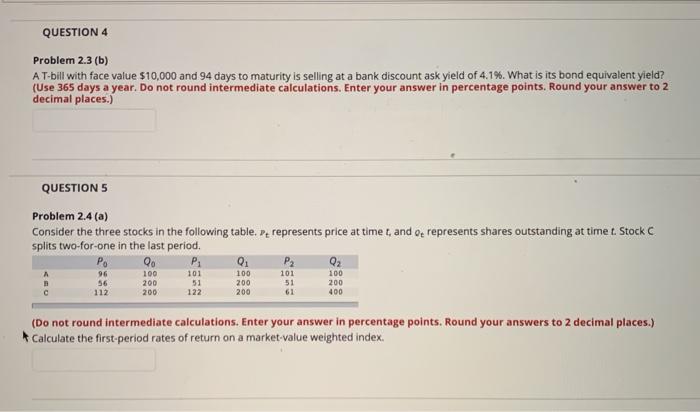

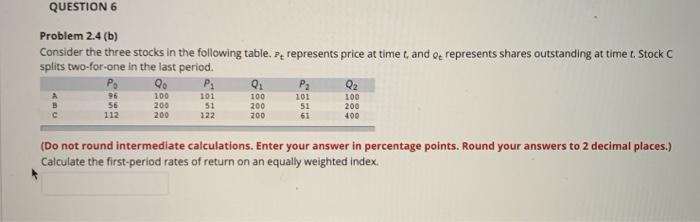

QUESTION 4 Problem 2.3 (b) AT-bill with face value $10,000 and 94 days to maturity is selling at a bank discount ask yield of 4.1%. What is its bond equivalent yield? (Use 365 days a year. Do not round intermediate calculations. Enter your answer in percentage points. Round your answer to 2 decimal places.) QUESTION 5 Problem 2.4 (a) Consider the three stocks in the following table. Pe represents price at time t, and or represents shares outstanding at timet. Stock C splits two-for-one in the last period. Po 06 P. o Q2 96 200 51 100 100 101 101 51 122 56 112 200 100 200 400 200 200 61 (Do not round intermediate calculations. Enter your answer in percentage points. Round your answers to 2 decimal places.) Calculate the first-period rates of return on a market value weighted index QUESTION 6 Problem 2.4 (b) Consider the three stocks in the following table. Pe represents price at time, and represents shares outstanding at time t. Stock splits two-for-one in the last period. QO P: Q. . Q2 96 100 101 100 101 100 56 200 51 200 51 200 112 200 322 200 61 400 (Do not round intermediate calculations. Enter your answer in percentage points. Round your answers to 2 decimal places.) Calculate the first-period rates of return on an equally weighted index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts