Question: Question 4 Question 1 Hanafi is a financial manager at Luxe Empire Berhad. As a financial manager he is responsible for growing company wealth. He

Question Question

Hanafi is a financial manager at Luxe Empire Berhad. As a financial manager he is responsible

for growing company wealth. He was asked to consider the following independent project for

investment.

The initial investment and aftertax cash inflows associated with each project are shown in the

following table:

From the above information, you are required to calculate for each investment:

a Calculate the payback period for each project.

b calculate the net present value for each project, given Luxe Empire Berhad required rate of

return is

c calculate the internal rate of return for each project.

d Based answer for a and b Justify, which investment should Hanafi choose? Explain your

answer. Question

a

Nur Syurga has a saving of RM and is planning to make her first investment. Kim Loong her

Option A : Samsung Bond with par value of RM pays coupon payment semiannually, matures

Option B : Air Asia preferred stock paying a dividend of RM and selling for RM

Option C: Unitar Capital dividend, with rate grow at this year, on the second year, on the

third year and thereafter. The current dividend Do is RM and the srock is selling at RM

The required rate of return for the above investments is as follows: required rate of return

i

Calculate the value of each investment option.

ii

Which investment should Nur Syurga choose. Explain your answer. Question

Miss Sai Mei is the newly appointed Finance Manager at Megah Holding Berhad. Her first assignment is ot report to the Board of Directors on

the company's current cost of capital. She is presented with the following information:

Megah Holding Berhad Statement of Financial Position as at December

Information:

Longterm debt consists of coupon bonds and a yield of maturity is maturing ni five years. The face value of the bond si RM

Megah Holding Berhad issue perpetual preferred stock at a price of RM a share. The stock is paying a constant annual dividend of RM

a share and has a required rate of return of

Market riskfree rate is and the average return on the market is The compan's equity beta is

Corporate tax is per annum.

From the above information you are required to:

a Calculate the:

i cost of common stocks

ii cost of debt

iii. cost of preferred stocks

b based on your calculation in part a determine Megah Holding Berhad's Weighted Average Cost of Capital WACC

c Megah Holding Berhad is considering a project called BigBang project that has a rate of return of Should ti take on this project? Explain

your answer.

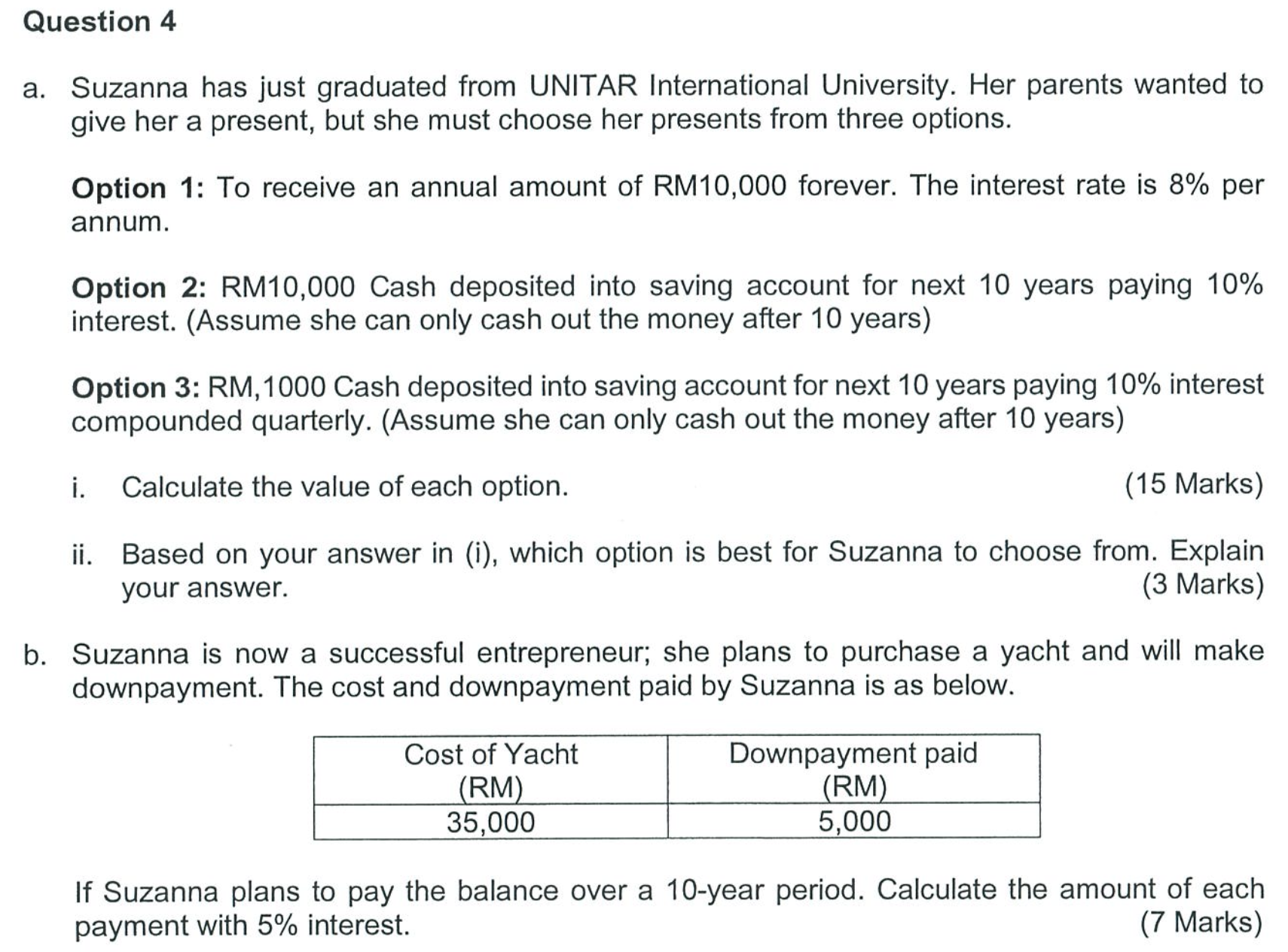

a Suzanna has just graduated from UNITAR International University. Her parents wanted to

give her a present, but she must choose her presents from three options.

Option : To receive an annual amount of RM forever. The interest rate is per

annum.

Option : RM Cash deposited into saving account for next years paying

interest. Assume she can only cash out the money after years

Option : RM Cash deposited into saving account for next years paying interest

compounded quarterly. Assume she can only cash out the money after years

i Calculate the value of each option.

Marks

ii Based on your answer in i which option is best for Suzanna to choose from. Explain

your answer.

Marks

b Suzanna is now a successful entrepreneur; she plans to purchase a yacht and will make

downpayment. The cost and downpayment paid by Suzanna is as below.

If Suzanna plans to pay the balance over a year period. Calculate the amount of each

payment with interest.

Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock