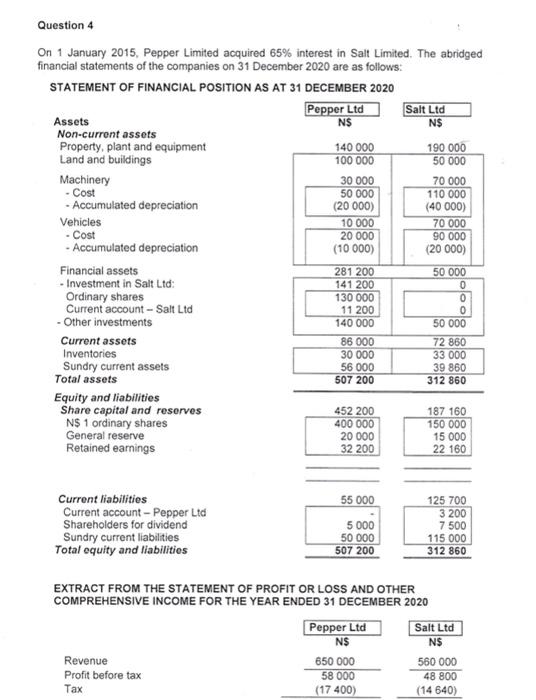

Question: QUESTION 4 Question 4 On 1 January 2015, Pepper Limited acquired 65% interest in Salt Limited. The abridged financial statements of the companies on 31

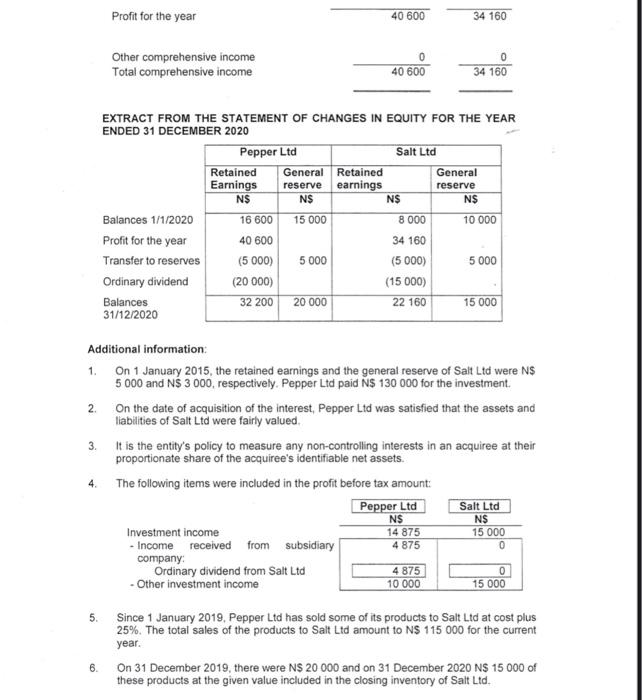

Question 4 On 1 January 2015, Pepper Limited acquired 65% interest in Salt Limited. The abridged financial statements of the companies on 31 December 2020 are as follows: STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020 Pepper Ltd Salt Ltd Assets N$ N$ Non-current assets Property, plant and equipment 140 000 190 000 Land and buildings 100 000 50 000 Machinery 30 000 70 000 - Cost 50 000 110 000 - Accumulated depreciation (20 000) (40 000) Vehicles 10 000 70 000 - Cost 20 000 90 000 - Accumulated depreciation (10 000) (20 000) Financial assets 281 200 50 000 - Investment in Salt Ltd 141 200 Ordinary shares 130 000 0 Current account - Salt Ltd 11 200 0 - Other investments 140 000 50 000 Current assets 86 000 72 860 Inventories 30 000 33 000 Sundry current assets 56 000 39 860 Total assets 507 200 312 860 Equity and liabilities Share capital and reserves 452 200 187 160 N$ 1 ordinary shares 400 000 150 000 General reserve 20 000 15 000 Retained earnings 32 200 22 160 0 Current liabilities Current account - Pepper Ltd Shareholders for dividend Sundry current liabilities Total equity and liabilities 55 000 5 000 50 000 507 200 125 700 3 200 7 500 115 000 312 860 EXTRACT FROM THE STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2020 Pepper Ltd Salt Ltd N$ NS Revenue 650 000 560 000 Profit before tax 58 000 48 800 Tax (17.400) (14 640) Profit for the year 40 600 34 160 Other comprehensive income Total comprehensive income 0 40 600 0 34 160 EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2020 Pepper Ltd Salt Ltd Retained General Retained General Earnings reserve earnings reserve N$ N$ NS NS 10 000 Balances 1/1/2020 Profit for the year Transfer to reserves Ordinary dividend Balances 31/12/2020 16 600 15 000 40 600 (5000) 5 000 (20 000) 32 200 20 000 8 000 34 160 (5000) (15000) 22 160 5 000 15 000 3 Additional information: 1 On 1 January 2015, the retained earnings and the general reserve of Salt Ltd were N$ 5 000 and NS 3 000, respectively. Pepper Ltd paid N$ 130 000 for the investment 2. On the date of acquisition of the interest, Pepper Ltd was satisfied that the assets and liabilities of Salt Ltd were fairly valued It is the entity's policy to measure any non-controlling interests in an acquiree at their proportionate share of the acquiree's identifiable net assets. 4. The following items were included in the profit before tax amount: Pepper Ltd Salt Ltd Investment income 14 875 15 000 - Income received from subsidiary company Ordinary dividend from Salt Ltd 4 875 - Other investment income 10 000 15 000 NS NS 4 875 0 0 5. Since 1 January 2019, Pepper Ltd has sold some of its products to Salt Ltd at cost plus 25%. The total sales of the products to Salt Ltd amount to N$ 115 000 for the current year. On 31 December 2019, there were NS 20 000 and on 31 December 2020 NS 15 000 of these products at the given value included in the closing inventory of Salt Ltd. 6 7. Included in the machinery of Pepper Ltd is equipment bought from Salt Ltd on 1 January 2020 for N$ 16 200. The details of the equipment (as originally purchased by Salt Ltd) are as follows: Purchase date: 1 January 2018 Cost price: N$ 18 500 Depreciation: 10% per year, straight line, residual value N$ nil (Pepper Ltd considers this rate to be fair.) 8. On 31 December 2020. Salt Ltd declared a final ordinary dividend of N$ 7 500 and recorded it in their financial records Pepper Ltd, however, did not record this dividend in their financial records. 9. The corporate tax rate is 32%. Required: a) Prepare the at acquisition date pro-forma journal entries for the 2020 group financial statements b) Prepare the pro-forma journal entries for the elimination of all intra-group transactions for the 2020 group financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts