Question: QUESTION 4 : Read the case study / scenario below and answer the question based on the case study. LK ( Pty ) Ltd (

QUESTION :

Read the case study scenario below and answer the question based on the

case study.

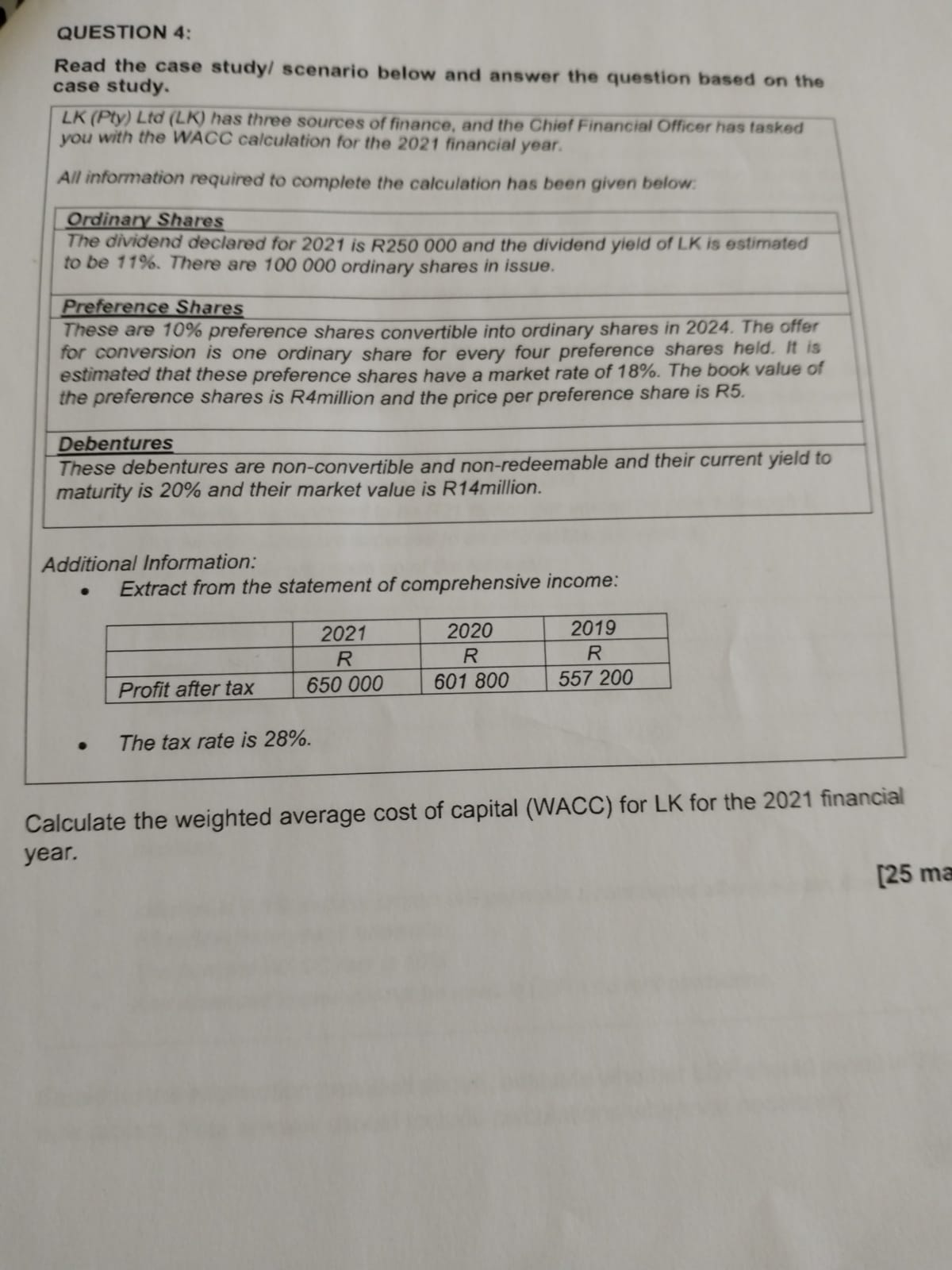

LK Pty Ltd LK has three sources of finance, and the Chief Financial Officer has tasked

you with the WACC calculation for the financial year.

All information required to complete the calculation has been given below:

Ordinary Shares

The dividend declared for is R and the dividend yield of LK is estimated

to be There are ordinary shares in issue.

Preference Shares

These are preference shares convertible into ordinary shares in The offer

for conversion is one ordinary share for every four preference shares held. It is

estimated that these preference shares have a market rate of The book value of

the preference shares is Rmillion and the price per preference share is R

Debentures

These debentures are nonconvertible and nonredeemable and their current yield to

maturity is and their market value is Rmillion.

Additional Information:

Extract from the statement of comprehensive income:

The tax rate is

Calculate the weighted average cost of capital WACC for LK for the financial

year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock