Question: QUESTION 4. Remember to put each final answer for a QUESTION on a separate piece of paper! And show your labelled work on the same

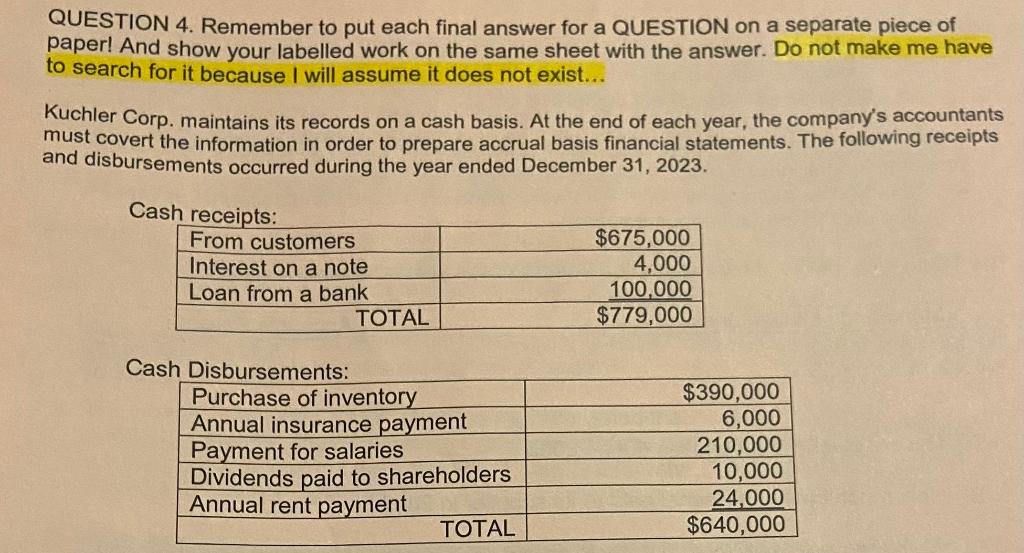

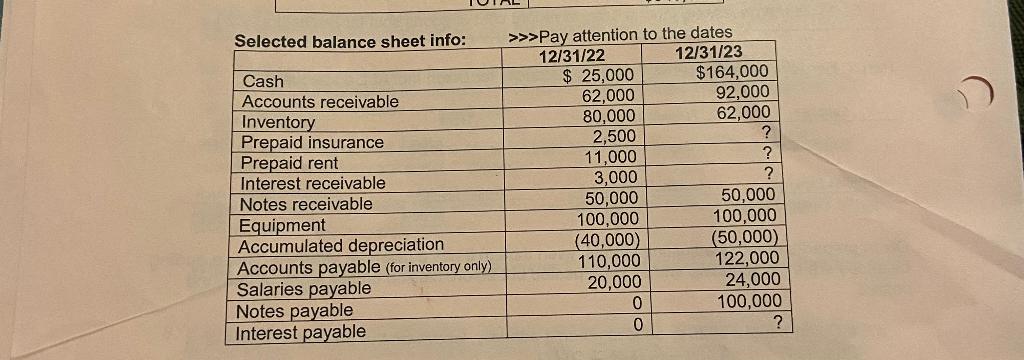

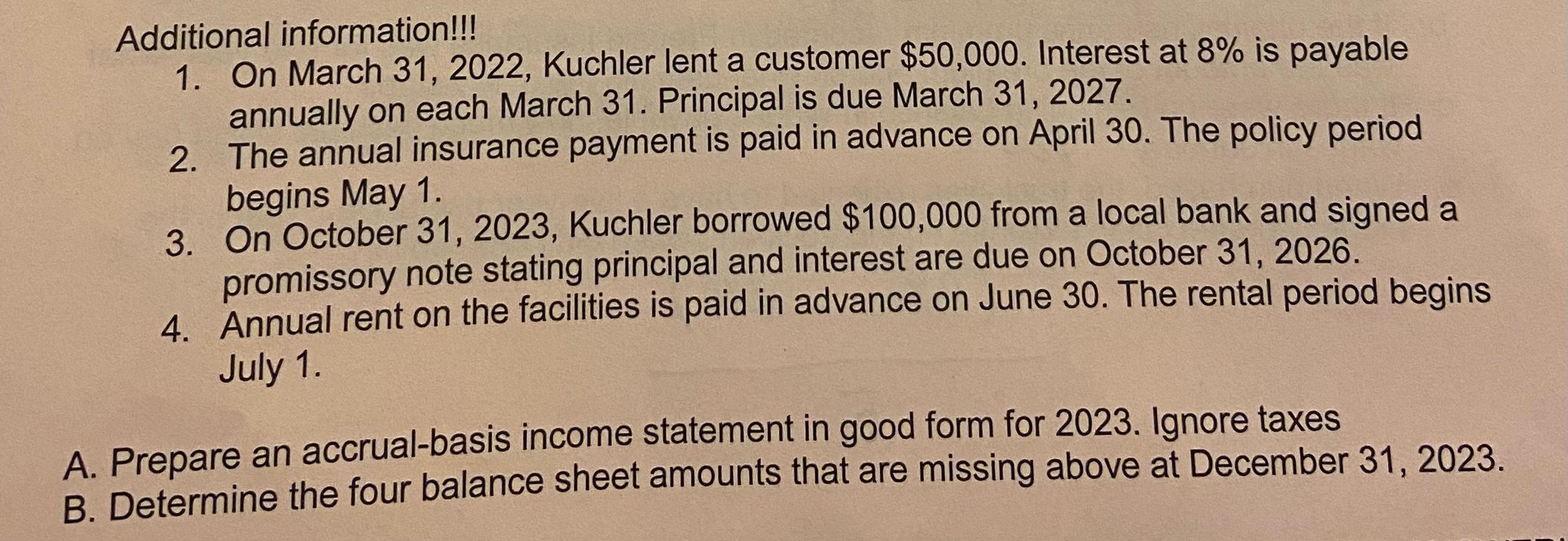

QUESTION 4. Remember to put each final answer for a QUESTION on a separate piece of paper! And show your labelled work on the same sheet with the answer. Do not make me have to search for it because I will assume it does not exist... Kuchler Corp. maintains its records on a cash basis. At the end of each year, the company's accountants must covert the information in order to prepare accrual basis financial statements. The following receipts and disbursements occurred during the year ended December 31, 2023. Ca Cas Selected balance sheet info: Pay attention to the dates \begin{tabular}{|l|r|r|} \hline & 12/31/22 & \multicolumn{1}{|c|}{12/31/23} \\ \hline Cash & $25,000 & $164,000 \\ \hline Accounts receivable & 62,000 & 92,000 \\ \hline Inventory & 80,000 & 62,000 \\ \hline Prepaid insurance & 2,500 & ? \\ \hline Prepaid rent & 11,000 & ? \\ \hline Interest receivable & 3,000 & ? \\ \hline Notes receivable & 50,000 & 50,000 \\ \hline Equipment & 100,000 & 100,000 \\ \hline Accumulated depreciation & (40,000) & (50,000) \\ \hline Accounts payable (for inventory only) & 110,000 & 122,000 \\ \hline Salaries payable & 20,000 & 24,000 \\ \hline Notes payable & 0 & 100,000 \\ \hline Interest payable & 0 & ? \\ \hline \end{tabular} Additional information!!! 1. On March 31,2022 , Kuchler lent a customer $50,000. Interest at 8% is payable annually on each March 31. Principal is due March 31, 2027. 2. The annual insurance payment is paid in advance on April 30. The policy period begins May 1. 3. On October 31,2023 , Kuchler borrowed $100,000 from a local bank and signed a promissory note stating principal and interest are due on October 31, 2026. 4. Annual rent on the facilities is paid in advance on June 30 . The rental period begins July 1. A. Prepare an accrual-basis income statement in good form for 2023. Ignore taxes B. Determine the four balance sheet amounts that are missing above at December 31, 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts