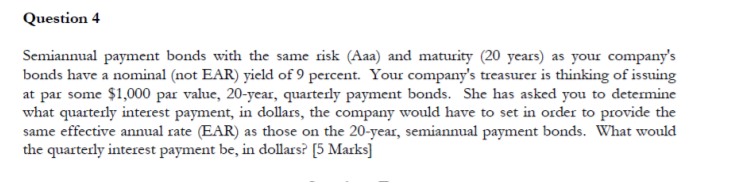

Question: Question 4 Semiannual payment bonds with the same risk (Aaa) and maturity (20 years) as your company's bonds have a nominal (not EAR) yield of

Question 4 Semiannual payment bonds with the same risk (Aaa) and maturity (20 years) as your company's bonds have a nominal (not EAR) yield of 9 percent. Your company's treasurer is thinking of issuing at par some $1,000 par value, 20-year, quarterly payment bonds. She has asked you to determine what quarterly interest payment, in dollars, the company would have to set in order to provide the same effective annual rate (EAR) as those on the 20-year, semiannual payment bonds. What would the quarterly interest payment be, in dollars? [5 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts