Question: Question 4 - Show your workings. a. RMS Bhd. has 20,000 shares outstanding and an earning of RM100,000. The current stock price is RM40.

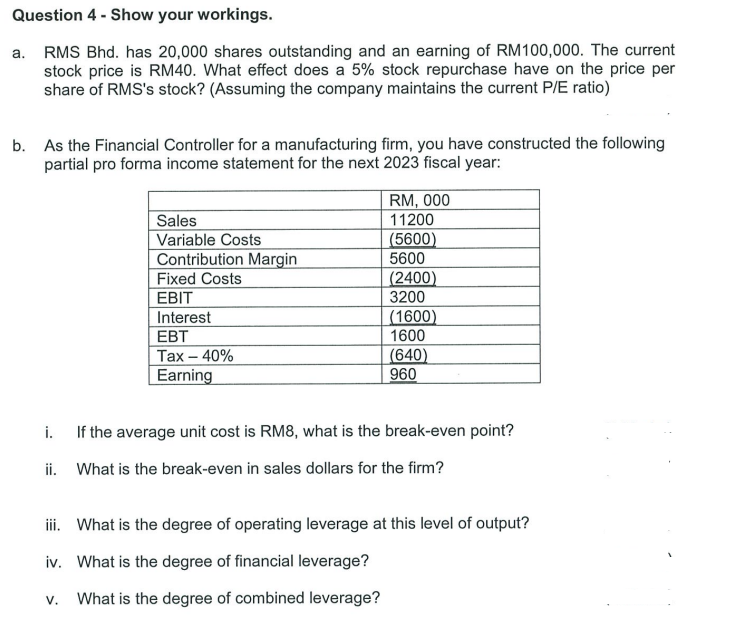

Question 4 - Show your workings. a. RMS Bhd. has 20,000 shares outstanding and an earning of RM100,000. The current stock price is RM40. What effect does a 5% stock repurchase have on the price per share of RMS's stock? (Assuming the company maintains the current P/E ratio) b. As the Financial Controller for a manufacturing firm, you have constructed the following partial pro forma income statement for the next 2023 fiscal year: Sales Variable Costs Contribution Margin Fixed Costs EBIT Interest EBT Tax - 40% Earning RM, 000 11200 (5600) 5600 (2400) 3200 (1600) 1600 (640) 960 i. If the average unit cost is RM8, what is the break-even point? ii. What is the break-even in sales dollars for the firm? iii. What is the degree of operating leverage at this level of output? iv. What is the degree of financial leverage? V. What is the degree of combined leverage?

Step by Step Solution

There are 3 Steps involved in it

Part 4 Stock Repurchase and Pro Forma Income Statement Analysis a Stock Repurchase and Share Price W... View full answer

Get step-by-step solutions from verified subject matter experts