Question: Question 4 SNAP is looking to purchase a small startup Omega for their AR technology. Omega will cost 5 0 0 million to buy out

Question

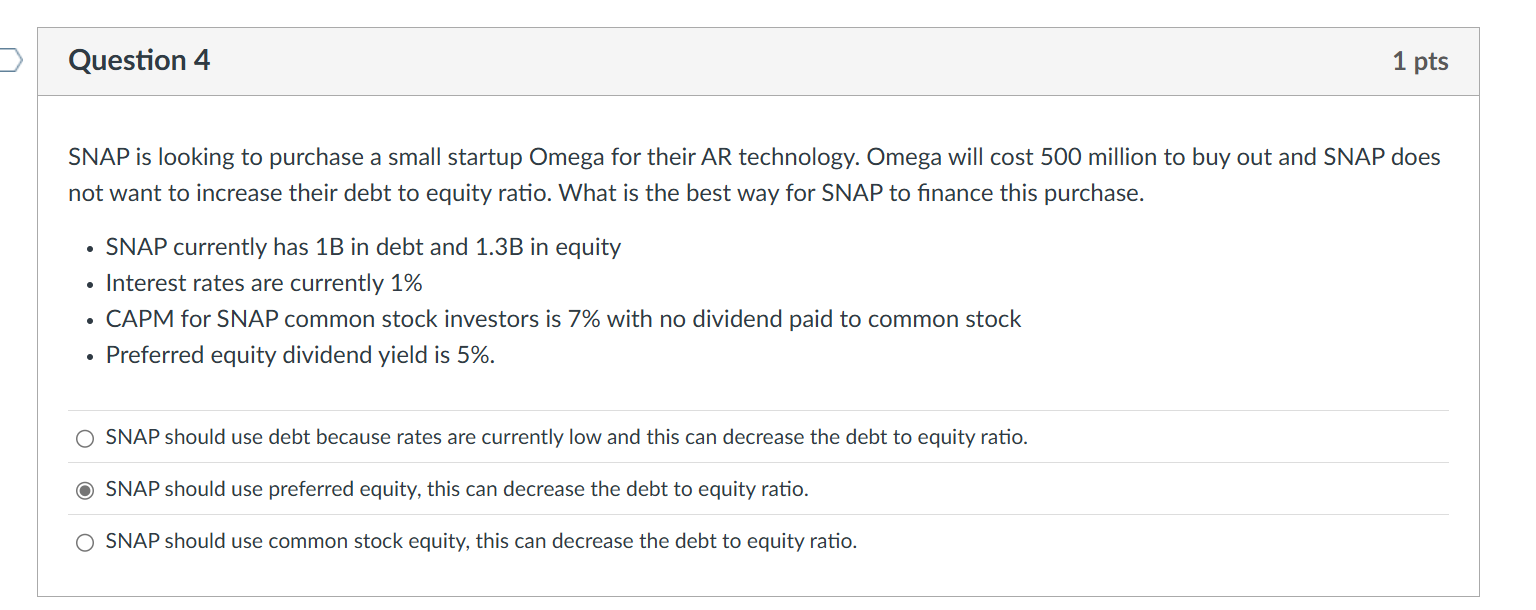

SNAP is looking to purchase a small startup Omega for their AR technology. Omega will cost million to buy out and SNAP does not want to increase their debt to equity ratio. What is the best way for SNAP to finance this purchase.

SNAP currently has B in debt and B in equity

Interest rates are currently

CAPM for SNAP common stock investors is with no dividend paid to common stock

Preferred equity dividend yield is

SNAP should use debt because rates are currently low and this can decrease the debt to equity ratio.

SNAP should use preferred equity, this can decrease the debt to equity ratio.

SNAP should use common stock equity, this can decrease the debt to equity ratio.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock