Question: Question 4: Solve the following (4 Marks a. Assume that the risk free rate is 4% and the market risk premium is 5% What is

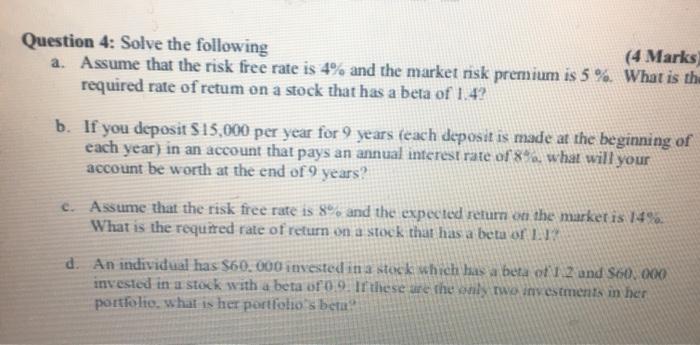

Question 4: Solve the following (4 Marks a. Assume that the risk free rate is 4% and the market risk premium is 5% What is the required rate of retum on a stock that has a beta of 1.47 b. If you deposit $15,000 per year for 9 years (each deposit is made at the beginning of each year) in an account that pays an annual interest rate of 8a, what will your account be worth at the end of 9 years? Assume that the risk free rate is 80% and the expected return on the market is 14% What is the required rate of return on a stock that has a beta or c d. An individual has $60.000 invested in a stock which has a beta o'l.2 und $60.000 invested in a stock with a beta oro. If these are the only two investments in her portfolio, what is her portfolio's beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts