Question: Question 4 Stanseess Tea Co. is considering two bonds, a 3-year bond paying annual coupon of 5 percent and a 10-year bond also with annual

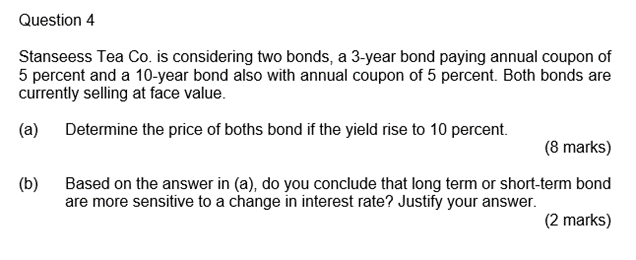

Question 4 Stanseess Tea Co. is considering two bonds, a 3-year bond paying annual coupon of 5 percent and a 10-year bond also with annual coupon of 5 percent. Both bonds are currently selling at face value. (a) Determine the price of boths bond if the yield rise to 10 percent. (8 marks) (b) Based on the answer in (a), do you conclude that long term or short-term bond are more sensitive to a change in interest rate? Justify your answer. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts