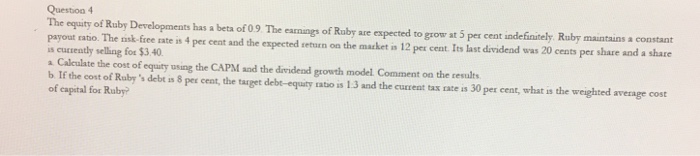

Question: Question 4 The equity of Ruby Developments has a beta of 0 9. The earnings of Ruby are expected to grow at 5 per ceat

Question 4 The equity of Ruby Developments has a beta of 0 9. The earnings of Ruby are expected to grow at 5 per ceat indefinitely Ruby maintains a constant payout ratio. The nisk fiee rate is 4 per cent and the expected seturn on the macket is 12 pex cent Its last dividend was 20 cents per share and a share is cutreatly selling for $3.40 a Caleulate the cost of equity using the CAPM and the diridend growth b If the cost of Raby's dabk in 8 per cent, the taget debe-equiay sa is 1 model Comment on the results hueta ate 30 per cent, what s he weighted avenage cos of capital for Ruby

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts