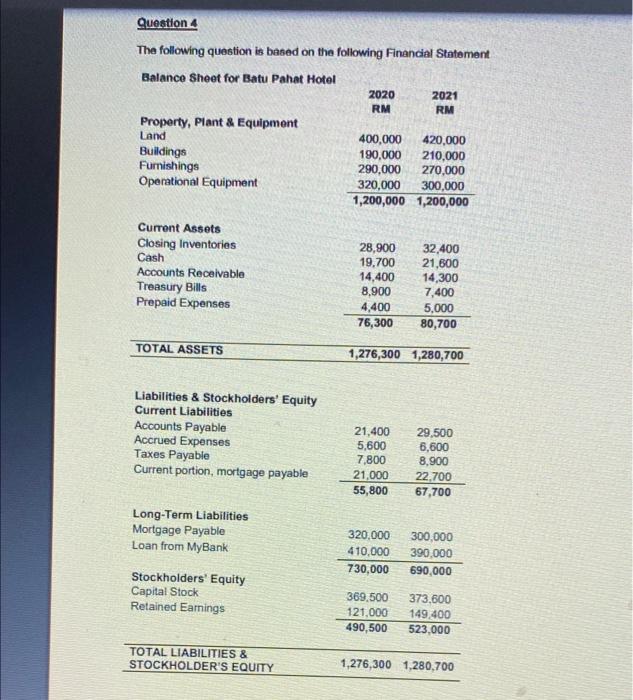

Question: Question 4 The following question is based on the following Financial Statement Balance Sheet for Batu Pahat Hotel 2020 2021 RM RM Property, Plant &

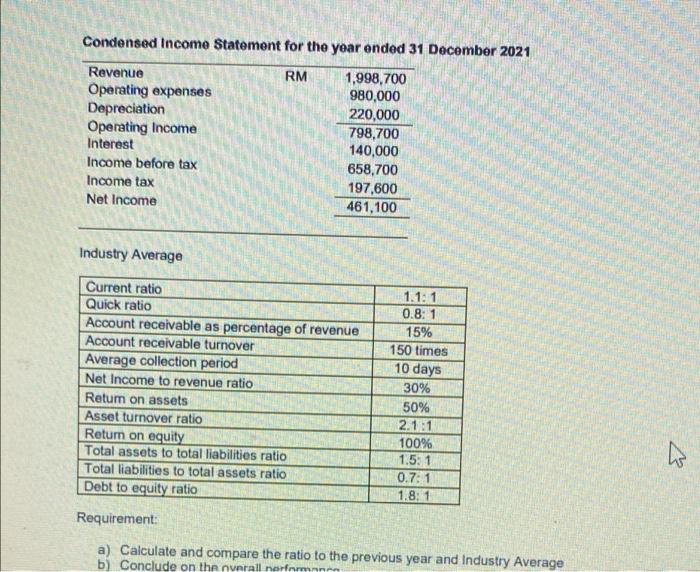

Question 4 The following question is based on the following Financial Statement Balance Sheet for Batu Pahat Hotel 2020 2021 RM RM Property, Plant & Equipment Land 400,000 420,000 Buildings 190,000 210,000 Furnishings 290,000 270.000 Operational Equipment 320,000 300,000 1,200,000 1,200,000 Current Assets Closing Inventories Cash Accounts Receivable Treasury Bills Prepaid Expenses 28,900 19.700 14,400 8.900 4,400 76,300 32,400 21,600 14,300 7,400 5,000 80,700 TOTAL ASSETS 1,276,300 1,280,700 Liabilities & Stockholders' Equity Current Liabilities Accounts Payable Accrued Expenses Taxes Payable Current portion, mortgage payable 21,400 5,600 7,800 21,000 55,800 29,500 6,600 8.900 22.700 67,700 Long-Term Liabilities Mortgage Payable Loan from MyBank 320,000 410.000 730,000 300,000 390,000 690,000 Stockholders' Equity Capital Stock Retained Earnings 369.500 121.000 490,500 373,600 149.400 523,000 TOTAL LIABILITIES & STOCKHOLDER'S EQUITY 1,276,300 1,280,700 Condensed Income Statement for the year ended 31 December 2021 RM Revenue Operating expenses Depreciation Operating Income Interest Income before tax Income tax Net Income 1,998,700 980,000 220,000 798,700 140,000 658,700 197,600 461,100 Industry Average Current ratio Quick ratio Account receivable as percentage of revenue Account receivable turnover Average collection period Net Income to revenue ratio Retum on assets Asset turnover ratio Retum on equity Total assets to total liabilities ratio Total liabilities to total assets ratio Debt to equity ratio 1.1: 1 0.8: 1 15% 150 times 10 days 30% 50% 2.1:1 100% 1.5: 1 0.7: 1 1.8: 1 Requirement: a) Calculate and compare the ratio to the previous year and Industry Average b) Conclude on the numrall norfor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts