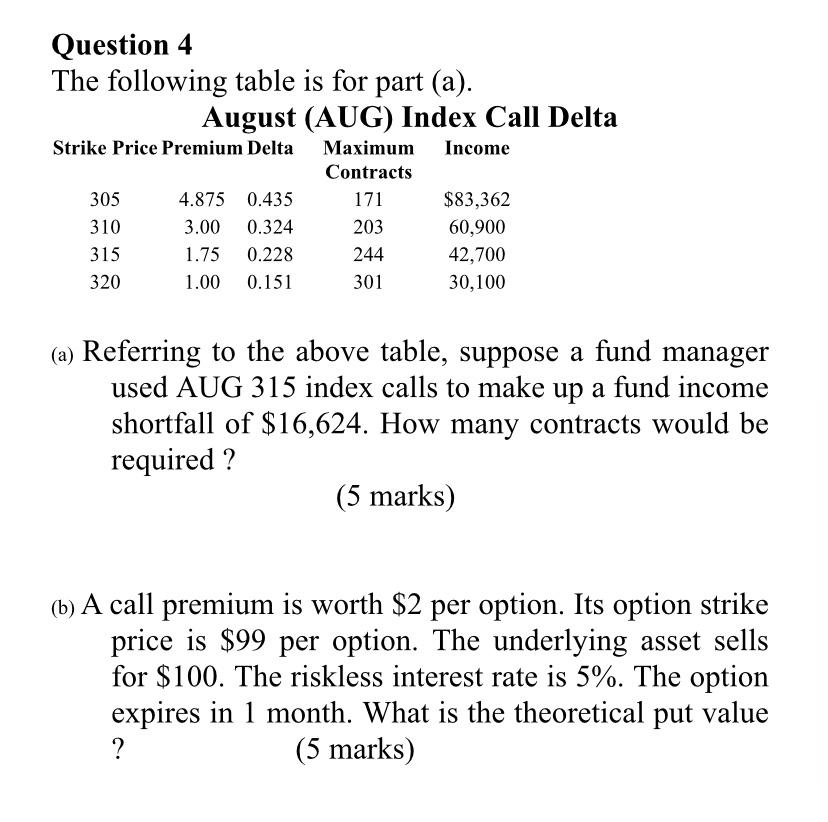

Question: Question 4 The following table is for part (a). August (AUG) Index Call Delta Strike Price Premium Delta Maximum Income Contracts 305 4.875 0.435 171

Question 4 The following table is for part (a). August (AUG) Index Call Delta Strike Price Premium Delta Maximum Income Contracts 305 4.875 0.435 171 $83,362 310 3.00 0.324 203 60,900 315 1.75 0.228 244 42,700 320 1.00 0.151 301 30,100 (a) Referring to the above table, suppose a fund manager used AUG 315 index calls to make up a fund income shortfall of $16,624. How many contracts would be required ? (5 marks) (b) A call premium is worth $2 per option. Its option strike price is $99 per option. The underlying asset sells for $100. The riskless interest rate is 5%. The option expires in 1 month. What is the theoretical put value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts