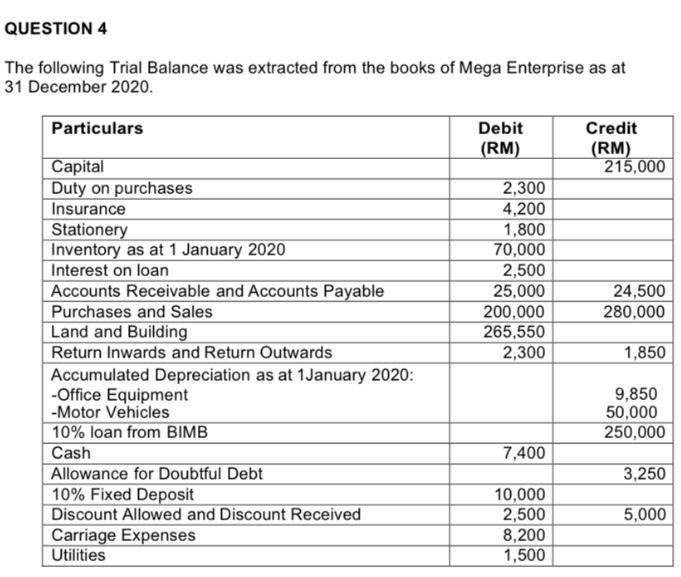

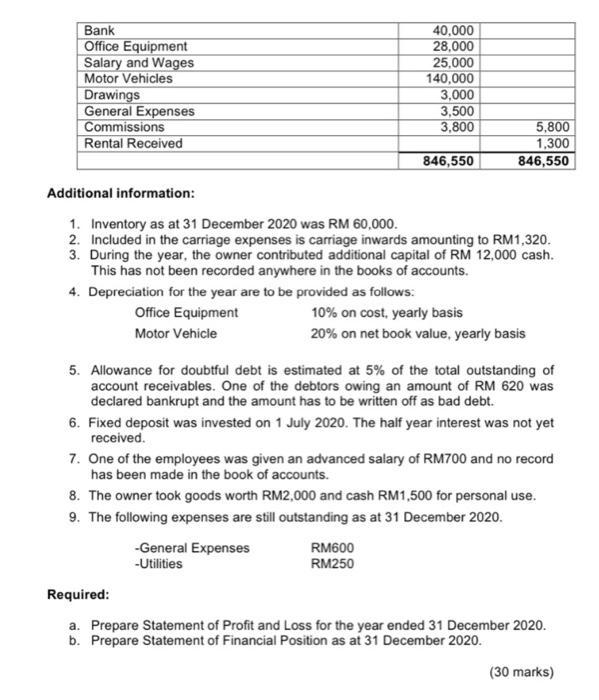

QUESTION 4 The following Trial Balance was extracted from the books of Mega Enterprise as at...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

QUESTION 4 The following Trial Balance was extracted from the books of Mega Enterprise as at 31 December 2020. Particulars Debit (RM) Credit (RM) Capital 215,000 Duty on purchases 2,300 Insurance 4,200 Stationery 1,800 Inventory as at 1 January 2020 70,000 Interest on loan 2,500 Accounts Receivable and Accounts Payable 25,000 24,500 Purchases and Sales 200,000 280,000 Land and Building 265,550 Return Inwards and Return Outwards 2,300 1,850 Accumulated Depreciation as at 1January 2020: -Office Equipment 9,850 -Motor Vehicles 50,000 10% loan from BIMB 250,000 Cash 7,400 Allowance for Doubtful Debt 3,250 10% Fixed Deposit 10,000 Discount Allowed and Discount Received 2,500 5,000 Carriage Expenses 8,200 Utilities 1,500 Bank 40,000 Office Equipment 28,000 Salary and Wages 25,000 Motor Vehicles 140,000 Drawings 3,000 General Expenses Commissions Rental Received 3,500 3,800 5,800 1,300 846,550 846,550 Additional information: 1. Inventory as at 31 December 2020 was RM 60,000. 2. Included in the carriage expenses is carriage inwards amounting to RM1,320. 3. During the year, the owner contributed additional capital of RM 12,000 cash. This has not been recorded anywhere in the books of accounts. 4. Depreciation for the year are to be provided as follows: Office Equipment Motor Vehicle 10% on cost, yearly basis 20% on net book value, yearly basis 5. Allowance for doubtful debt is estimated at 5% of the total outstanding of account receivables. One of the debtors owing an amount of RM 620 was declared bankrupt and the amount has to be written off as bad debt. 6. Fixed deposit was invested on 1 July 2020. The half year interest was not yet received. 7. One of the employees was given an advanced salary of RM700 and no record has been made in the book of accounts. 8. The owner took goods worth RM2,000 and cash RM1,500 for personal use. 9. The following expenses are still outstanding as at 31 December 2020. -General Expenses -Utilities Required: RM600 RM250 a. Prepare Statement of Profit and Loss for the year ended 31 December 2020. b. Prepare Statement of Financial Position as at 31 December 2020. (30 marks) QUESTION 4 The following Trial Balance was extracted from the books of Mega Enterprise as at 31 December 2020. Particulars Debit (RM) Credit (RM) Capital 215,000 Duty on purchases 2,300 Insurance 4,200 Stationery 1,800 Inventory as at 1 January 2020 70,000 Interest on loan 2,500 Accounts Receivable and Accounts Payable 25,000 24,500 Purchases and Sales 200,000 280,000 Land and Building 265,550 Return Inwards and Return Outwards 2,300 1,850 Accumulated Depreciation as at 1January 2020: -Office Equipment 9,850 -Motor Vehicles 50,000 10% loan from BIMB 250,000 Cash 7,400 Allowance for Doubtful Debt 3,250 10% Fixed Deposit 10,000 Discount Allowed and Discount Received 2,500 5,000 Carriage Expenses 8,200 Utilities 1,500 Bank 40,000 Office Equipment 28,000 Salary and Wages 25,000 Motor Vehicles 140,000 Drawings 3,000 General Expenses Commissions Rental Received 3,500 3,800 5,800 1,300 846,550 846,550 Additional information: 1. Inventory as at 31 December 2020 was RM 60,000. 2. Included in the carriage expenses is carriage inwards amounting to RM1,320. 3. During the year, the owner contributed additional capital of RM 12,000 cash. This has not been recorded anywhere in the books of accounts. 4. Depreciation for the year are to be provided as follows: Office Equipment Motor Vehicle 10% on cost, yearly basis 20% on net book value, yearly basis 5. Allowance for doubtful debt is estimated at 5% of the total outstanding of account receivables. One of the debtors owing an amount of RM 620 was declared bankrupt and the amount has to be written off as bad debt. 6. Fixed deposit was invested on 1 July 2020. The half year interest was not yet received. 7. One of the employees was given an advanced salary of RM700 and no record has been made in the book of accounts. 8. The owner took goods worth RM2,000 and cash RM1,500 for personal use. 9. The following expenses are still outstanding as at 31 December 2020. -General Expenses -Utilities Required: RM600 RM250 a. Prepare Statement of Profit and Loss for the year ended 31 December 2020. b. Prepare Statement of Financial Position as at 31 December 2020. (30 marks)

Expert Answer:

Related Book For

Introduction To Financial Accounting

ISBN: 978-0077138448

7th edition

Authors: Anne Marie Ward, Andrew Thomas

Posted Date:

Students also viewed these accounting questions

-

Face Hedge Inc. had issued 9 % semi - annual coupon bonds. 5 years remain for them to mature. The market interest rate is 7 % p . a . i ) What is the duration of these bonds? ii ) If the market rate...

-

Commencing in 2022, the Federal Reserve raised short term interest rates after an extended period of extremely low rates resulting in net interest losses for the Federal Reserve. As such, B) The...

-

Homework #2 Two forces F1 and F2 have a resultant force of - 100 k lb. Determine the magnitude and coordinate angles of F2 F 50 <30 F 60 lb Express each force as a Cartesian vector and then determine...

-

The Carter Caterer Company must have the following number of clean napkins available at the beginning of each of the next four days: day 1, 1500; day 2, 1200; day 3, 1800; day 4, 600. After being...

-

For each of the scenarios below, determine whether you think it is likely that an employer could be discriminating against a person because of his or her age. Explain why or why not. a. A young...

-

To make a parallel plate capacitor, you have available two flat plates of aluminum (area 120 cm2), a sheet of paper (thickness = 0.10 mm, k = 3.5), a sheet of glass (thickness = 2.0 mm, k = 7.0), and...

-

Read the article Take Me Online to the Ball Game, in the April 9, 2001, issue of Business Week. (This books Website provides a free link.) Required 1. What is the business relation between Major...

-

Block B, with mass 5.00 kg, rests on block A, with mass 8.00 kg, which in turn is on a horizontal tabletop (Fig. 5.72). There is no friction between block A and the tabletop, but the coefficient of...

-

6.4 in3 3.7 in3 0.6375 in3 1 in 1.7 in 1 in h=0.5 in h=1.5 in

-

The WACC is used as the discount rate to evaluate various capital budgeting projects. However, it is important to realize that the WACC is an appropriate discount rate only for a project of average...

-

Q1) What is the total percentage retum for an investor who purchased a stock for $6.93, received $1.33 in dividend payments, and sold the stock for $8.42? (2

-

WannaDance Corporation is considering issuing common shares. Their market price is currently $73.50, but the firm would like to verify the offering price. The following data is available: Beta 1.14...

-

A portfolio manager is considering the performance by analysing the following information on a holding in the company 9 Shot Plc. The stock was initially purchased for 120,000 and then sold for...

-

prepare an accounting equation for the accounts receivable balance and allowance for uncollectible. Also, explain why companies adopt the adjusted allowance method. Remember to use the excel file and...

-

In Chicago, deterioration of trucks from road salt used in winter months may require early replacement of body parts if not the whole truck. Alternative methods of handling this situation from the...

-

Some people probably think, especially for property crimes, it isn't worth the hassle. Do you think property crimes, especially things like stealing packages off porches, or something like that, are...

-

Determine the resultant moment produced by the forces about point O. 0.25 m 0.125 m, 0 0.3 m- 60 F = 500 N F = 600 N

-

Antonio Rossi set up a part-time business on 1 November 2004 buying and selling second-hand sports cars. On 1 November 2004 he commenced business with $66,000 which he immediately used to purchase...

-

Why is it necessary for financial reporting to be subject to (a) mandatory control and (b) statutory control?

-

How is it possible to make shareholders aware of the significance of the exercise of judgement by directors which can turn profits of 6m into losses of 2m?

Study smarter with the SolutionInn App