Question: Question 4 The payment on a note is recorded, by the maker or payer, as a O debit. Cash credit. Notes Payable: credit, interest Expense

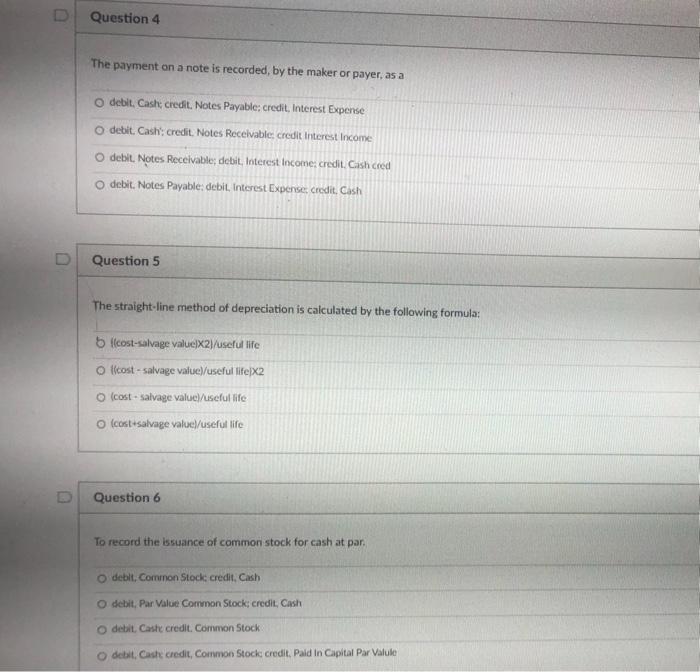

Question 4 The payment on a note is recorded, by the maker or payer, as a O debit. Cash credit. Notes Payable: credit, interest Expense O debit. Cash: credit. Notes Receivable: credit Interest Income O debit. Notes Receivable; debit, Interest Income: credit. Cash cred O debit. Notes Payable: debit. Interest Expense Credit Cash Question 5 The straight-line method of depreciation is calculated by the following formula: 5 cost-salvage value]X2]/useful life o cost-salvage value)/useful lifeX2 (cost salvage value)/useful life (cost salvage value/useful life Question 6 To record the issuance of common stock for cash at par O debit, Common Stock credit. Cash O debit, Par Value Common Stock: credit, Cash debit Cashe credit. Common Stock O debit Cashe credit, Common Stock credit, Paid in Capital Par Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts