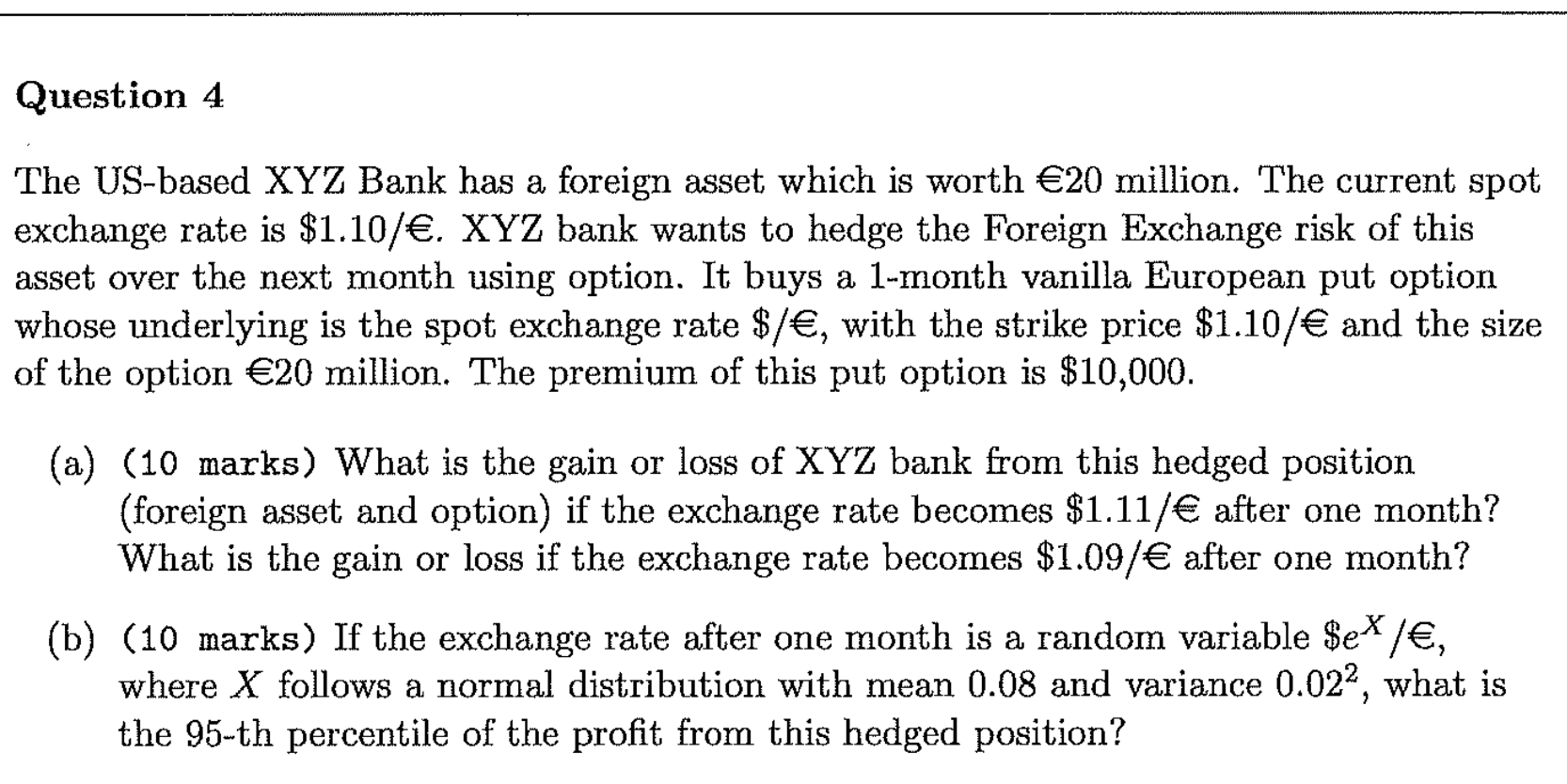

Question: Question 4 The US - based XYZ Bank has a foreign asset which is worth 2 0 million. The current spot exchange rate is $

Question

The USbased XYZ Bank has a foreign asset which is worth million. The current spot

exchange rate is $ XYZ bank wants to hedge the Foreign Exchange risk of this

asset over the next month using option. It buys a month vanilla European put option

whose underlying is the spot exchange rate with the strike price $ and the size

of the option million. The premium of this put option is $

a marks What is the gain or loss of XYZ bank from this hedged position

foreign asset and option if the exchange rate becomes $ after one month?

What is the gain or loss if the exchange rate becomes $ after one month?

b marks If the exchange rate after one month is a random variable $

where follows a normal distribution with mean and variance what is

the th percentile of the profit from this hedged position? Question Question

A Financial Institution considers a year loan with the following attributes

The Financial Institution estimates that the borrower of the loan has a year default

probability of ; however, if default happens, no value can be recovered from this loan.

a marks What is the gross return per dollar lent of this loan?

b marks What is the expected loss of this loan due to default risk?

Consider a bank whose asset and liability both consist of bonds only. The asset consists of

a year coupon bond with face value $ million, coupon rate and its coupons

are paid once per year. The liability consists of a year zero coupon bond with face value

$ million. The current yield for all these bonds are

a marks What is the bank's current market value of equity expressed in million

dollars

b marks What is the bank's current leverageadjusted modified duration gap?

c marks Assume parallel yield shift. Based on the prediction from the duration

model, how much would the market value of equity change expressed in million

dollars for a basis points increase in the yield?

d marks Assume parallel yield shift. Based on the prediction from the duration

model, what is the range of the yield change expressed in basis points for which

the market value of equity would become negative?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock