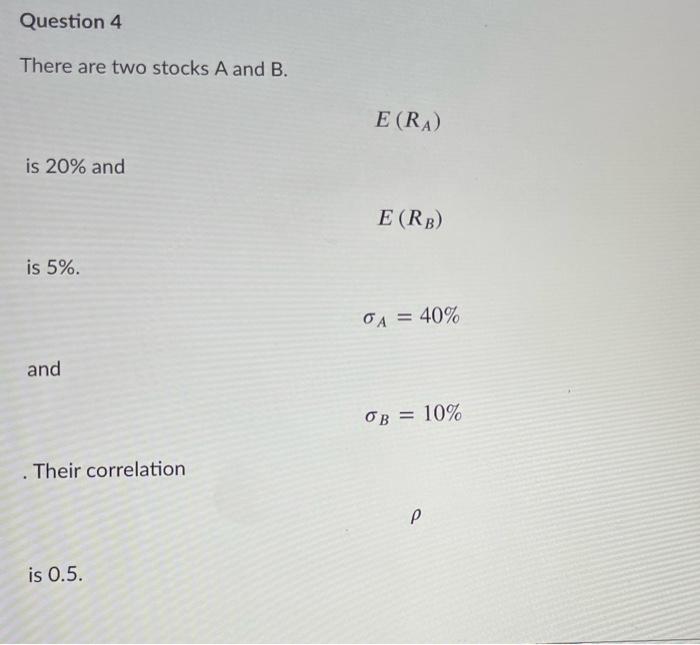

Question: Question 4 There are two stocks A and B. E(RA) is 20% and E (RB) is 5%. A = 40% and OB = 10% Their

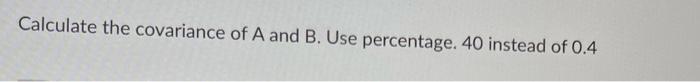

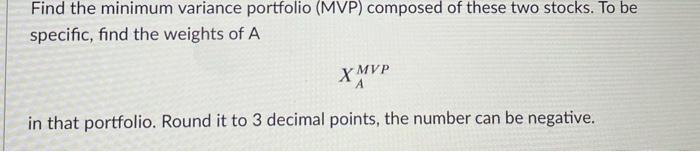

Question 4 There are two stocks A and B. E(RA) is 20% and E (RB) is 5%. A = 40% and OB = 10% Their correlation is 0.5. Calculate the covariance of A and B. Use percentage. 40 instead of 0.4 Find the minimum variance portfolio (MVP) composed of these two stocks. To be specific, find the weights of A XMVP in that portfolio. Round it to 3 decimal points, the number can be negative. Using weights of A and B in MVP. Calculate the expected return of MVP. Use percentage point. For example, if your answer is 5.6%, just write down 5.6. Round it to one decimal point. Using weights of A and B in MVP. Calculate the standard deviation of MVP. Use percentage point. For example, if your answer is 5.6%, just write down 5.6. Round it to one decimal point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts