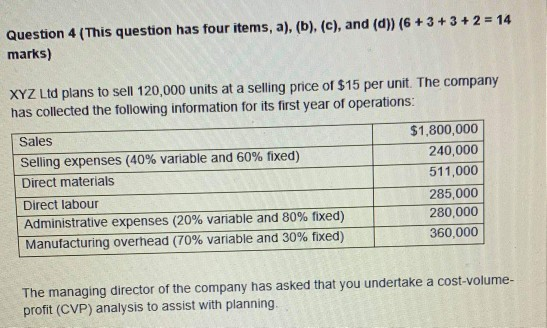

Question: Question 4 (This question has four items, a), (b), (c), and (d)) (6 + 3 + 3 + 2 = 14 marks) XYZ Ltd plans

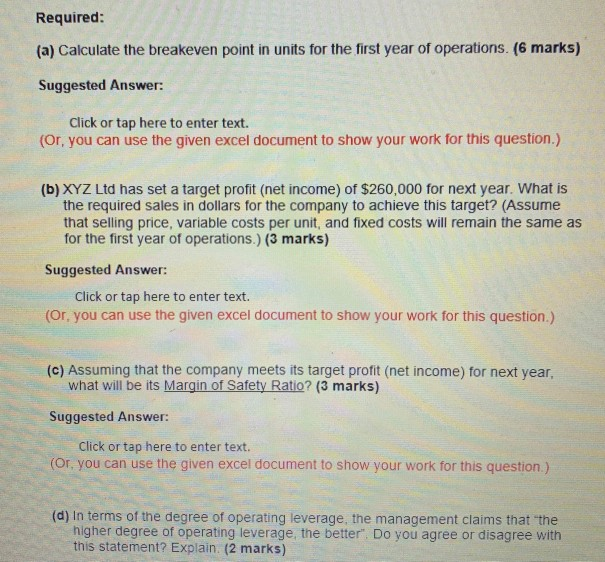

Question 4 (This question has four items, a), (b), (c), and (d)) (6 + 3 + 3 + 2 = 14 marks) XYZ Ltd plans to sell 120,000 units at a selling price of $15 per unit. The company has collected the following information for its first year of operations: Sales Selling expenses (40% variable and 60% fixed) Direct materials Direct labour Administrative expenses (20% variable and 80% fixed) Manufacturing overhead (70% variable and 30% fixed) $1,800,000 240,000 511,000 285,000 280,000 360,000 The managing director of the company has asked that you undertake a cost-volume- profit (CVP) analysis to assist with planning. Required: (a) Calculate the breakeven point in units for the first year of operations. (6 marks) Suggested Answer: Click or tap here to enter text. (Or, you can use the given excel document to show your work for this question.) (b) XYZ Ltd has set a target profit (net income) of $260,000 for next year. What is the required sales in dollars for the company to achieve this target? (Assume that selling price, variable costs per unit, and fixed costs will remain the same as for the first year of operations.) (3 marks) Suggested Answer: Click or tap here to enter text. (Or, you can use the given excel document to show your work for this question.) (c) Assuming that the company meets its target profit (net income) for next year, what will be its Margin of Safety Ratio? (3 marks) Suggested Answer: Click or tap here to enter text. (Or, you can use the given excel document to show your work for this question.) (d) In terms of the degree of operating leverage, the management claims that the higher degree of operating leverage, the better". Do you agree or disagree with this statement? Explain. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts