Question: QUESTION 4 - This question has THREE parts (a), (b), and (c). Lily and William are in their early 60 s and nearing retirement. They

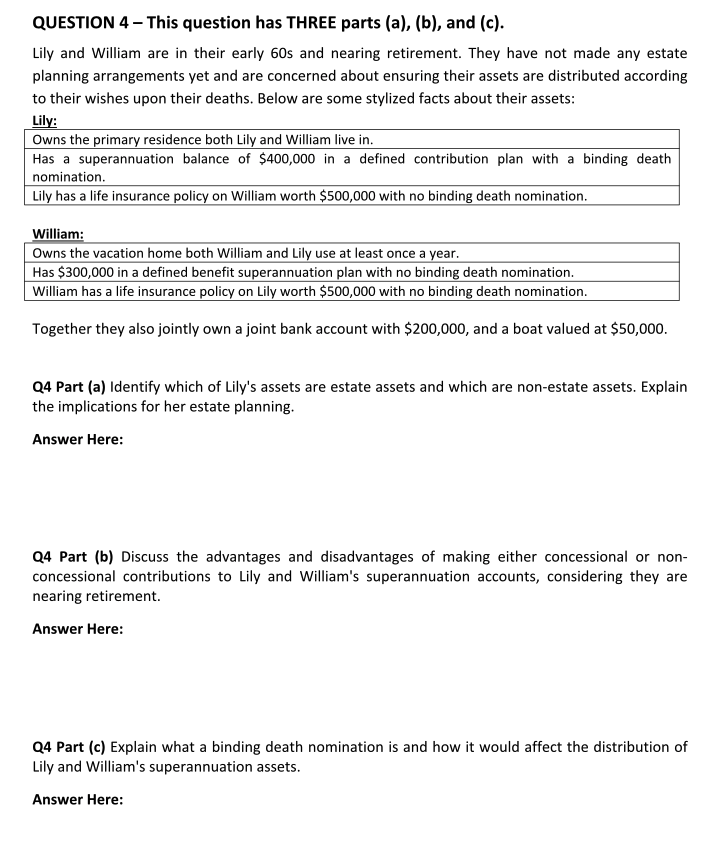

QUESTION 4 - This question has THREE parts (a), (b), and (c). Lily and William are in their early 60 s and nearing retirement. They have not made any estate planning arrangements yet and are concerned about ensuring their assets are distributed according to their wishes upon their deaths. Below are some stylized facts about their assets: I ilv. Together they also jointly own a joint bank account with $200,000, and a boat valued at $50,000. Q4 Part (a) Identify which of Lily's assets are estate assets and which are non-estate assets. Explain the implications for her estate planning. Answer Here: Q4 Part (b) Discuss the advantages and disadvantages of making either concessional or nonconcessional contributions to Lily and William's superannuation accounts, considering they are nearing retirement. Answer Here: Q4 Part (c) Explain what a binding death nomination is and how it would affect the distribution of Lily and William's superannuation assets. Answer Here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts