Question: Question 4 (this question has three parts, a) b) and c) (20 marks) Part a. Consider two firms with identical assets structures and operating characteristics:

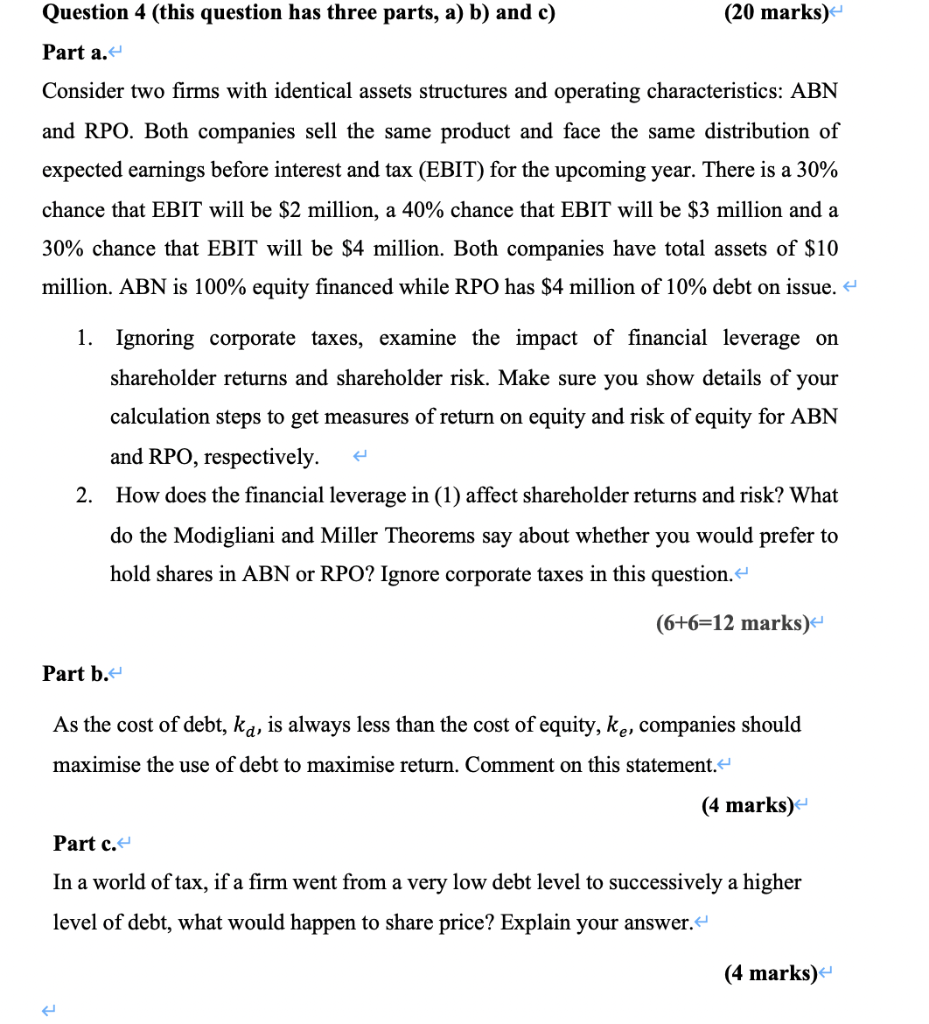

Question 4 (this question has three parts, a) b) and c) (20 marks) Part a. Consider two firms with identical assets structures and operating characteristics: ABN and RPO. Both companies sell the same product and face the same distribution of expected earnings before interest and tax (EBIT) for the upcoming year. There is a 30% chance that EBIT will be $2 million, a 40% chance that EBIT will be $3 million and a 30% chance that EBIT will be $4 million. Both companies have total assets of $10 million. ABN is 100% equity financed while RPO has $4 million of 10% debt on issue. 1. Ignoring corporate taxes, examine the impact of financial leverage on shareholder returns and shareholder risk. Make sure you show details of your calculation steps to get measures of return on equity and risk of equity for ABN and RPO, respectively. 2. How does the financial leverage in (1) affect shareholder returns and risk? What do the Modigliani and Miller Theorems say about whether you would prefer to hold shares in ABN or RPO? Ignore corporate taxes in this question. (6+6=12 marks) Part b. As the cost of debt, kq, is always less than the cost of equity, k, companies should maximise the use of debt to maximise return. Comment on this statement (4 marks) Part c. In a world of tax, if a firm went from a very low debt level to successively a higher level of debt, what would happen to share price? Explain your answer. - (4 marks) Question 4 (this question has three parts, a) b) and c) (20 marks) Part a. Consider two firms with identical assets structures and operating characteristics: ABN and RPO. Both companies sell the same product and face the same distribution of expected earnings before interest and tax (EBIT) for the upcoming year. There is a 30% chance that EBIT will be $2 million, a 40% chance that EBIT will be $3 million and a 30% chance that EBIT will be $4 million. Both companies have total assets of $10 million. ABN is 100% equity financed while RPO has $4 million of 10% debt on issue. 1. Ignoring corporate taxes, examine the impact of financial leverage on shareholder returns and shareholder risk. Make sure you show details of your calculation steps to get measures of return on equity and risk of equity for ABN and RPO, respectively. 2. How does the financial leverage in (1) affect shareholder returns and risk? What do the Modigliani and Miller Theorems say about whether you would prefer to hold shares in ABN or RPO? Ignore corporate taxes in this question. (6+6=12 marks) Part b. As the cost of debt, kq, is always less than the cost of equity, k, companies should maximise the use of debt to maximise return. Comment on this statement (4 marks) Part c. In a world of tax, if a firm went from a very low debt level to successively a higher level of debt, what would happen to share price? Explain your answer. - (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts