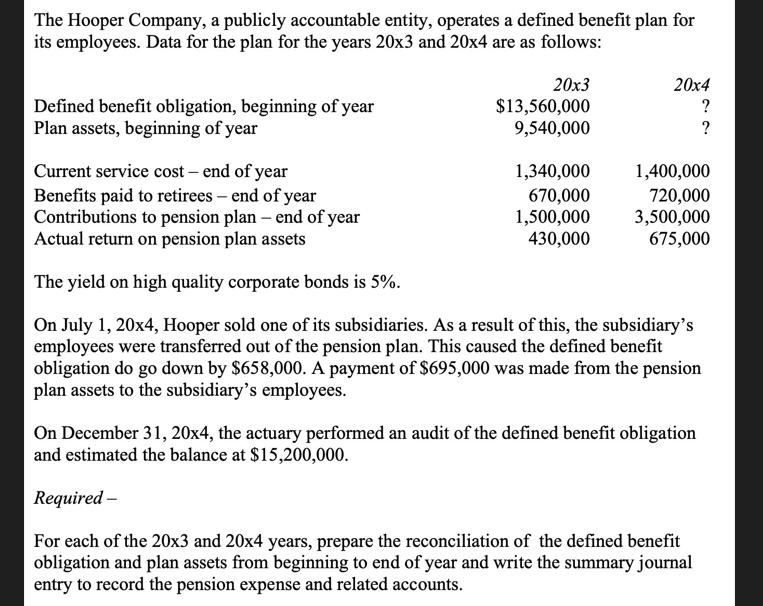

Question: The Hooper Company, a publicly accountable entity, operates a defined benefit plan for its employees. Data for the plan for the years 20x3 and

The Hooper Company, a publicly accountable entity, operates a defined benefit plan for its employees. Data for the plan for the years 20x3 and 20x4 are as follows: Defined benefit obligation, beginning of year Plan assets, beginning of year 20x3 $13,560,000 9,540,000 20x4 ? ? Current service cost - end of year Benefits paid to retirees - end of year Contributions to pension plan - end of year Actual return on pension plan assets The yield on high quality corporate bonds is 5%. On July 1, 20x4, Hooper sold one of its subsidiaries. As a result of this, the subsidiary's employees were transferred out of the pension plan. This caused the defined benefit obligation do go down by $658,000. A payment of $695,000 was made from the pension plan assets to the subsidiary's employees. 1,340,000 1,400,000 670,000 720,000 1,500,000 3,500,000 430,000 675,000 On December 31, 20x4, the actuary performed an audit of the defined benefit obligation and estimated the balance at $15,200,000. Required - For each of the 20x3 and 20x4 years, prepare the reconciliation of the defined benefit obligation and plan assets from beginning to end of year and write the summary journal entry to record the pension expense and related accounts.

Step by Step Solution

There are 3 Steps involved in it

Reconciliation and Journal Entries for Hooper Companys Defined Benefit Plan 20x3 Reconciliation of D... View full answer

Get step-by-step solutions from verified subject matter experts