Question: QUESTION 4 (TO BE DISCUSSED ON WEEK 9) En, Rahman. A Malaysian citizen passed away due to Covid 19 virus on 26 December 2021. En

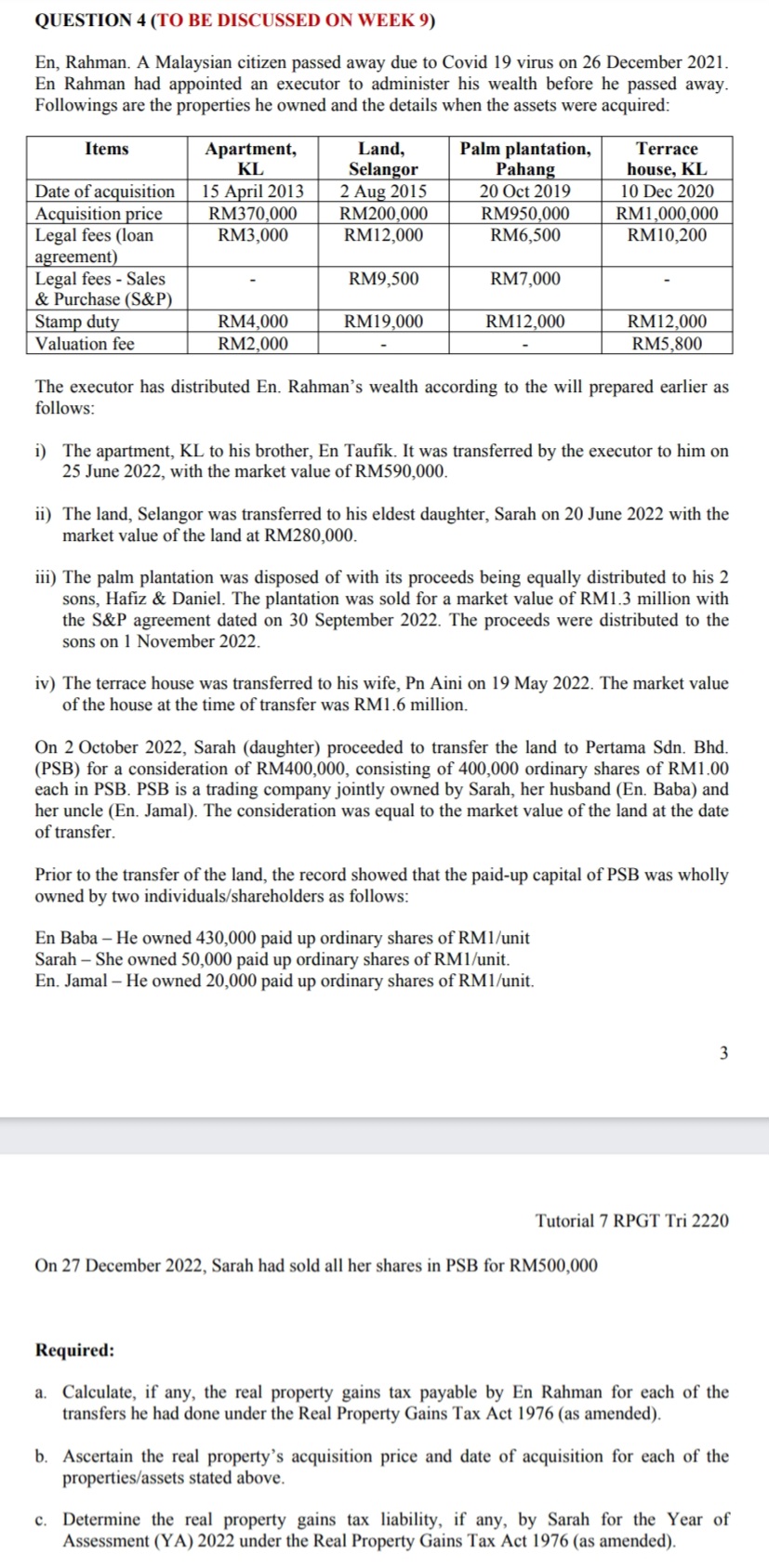

QUESTION 4 (TO BE DISCUSSED ON WEEK 9) En, Rahman. A Malaysian citizen passed away due to Covid 19 virus on 26 December 2021. En Rahman had appointed an executor to administer his wealth before he passed away. Followings are the properties he owned and the details when the assets were acquired: The executor has distributed En. Rahman's wealth according to the will prepared earlier as follows: i) The apartment, KL to his brother, En Taufik. It was transferred by the executor to him on 25 June 2022, with the market value of RM590,000. ii) The land, Selangor was transferred to his eldest daughter, Sarah on 20 June 2022 with the market value of the land at RM280,000. iii) The palm plantation was disposed of with its proceeds being equally distributed to his 2 sons, Hafiz \& Daniel. The plantation was sold for a market value of RM1.3 million with the S\&P agreement dated on 30 September 2022. The proceeds were distributed to the sons on 1 November 2022 . iv) The terrace house was transferred to his wife, Pn Aini on 19 May 2022. The market value of the house at the time of transfer was RM1.6 million. On 2 October 2022, Sarah (daughter) proceeded to transfer the land to Pertama Sdn. Bhd. (PSB) for a consideration of RM400,000, consisting of 400,000 ordinary shares of RM1.00 each in PSB. PSB is a trading company jointly owned by Sarah, her husband (En. Baba) and her uncle (En. Jamal). The consideration was equal to the market value of the land at the date of transfer. Prior to the transfer of the land, the record showed that the paid-up capital of PSB was wholly owned by two individuals/shareholders as follows: En Baba - He owned 430,000 paid up ordinary shares of RM1/unit Sarah - She owned 50,000 paid up ordinary shares of RM1/unit. En. Jamal - He owned 20,000 paid up ordinary shares of RM1/unit. 3 Tutorial 7 RPGT Tri 2220 On 27 December 2022, Sarah had sold all her shares in PSB for RM500,000 Required: a. Calculate, if any, the real property gains tax payable by En Rahman for each of the transfers he had done under the Real Property Gains Tax Act 1976 (as amended). b. Ascertain the real property's acquisition price and date of acquisition for each of the properties/assets stated above. c. Determine the real property gains tax liability, if any, by Sarah for the Year of Assessment (YA) 2022 under the Real Property Gains Tax Act 1976 (as amended)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts