Question: Question 4 (Total 15 marks) Portfolio Actual return Standard deviation Beta X 10.2% 12% 1.2 Y 8.8% 9.9% 0.8 Additionally, the risk premium for the

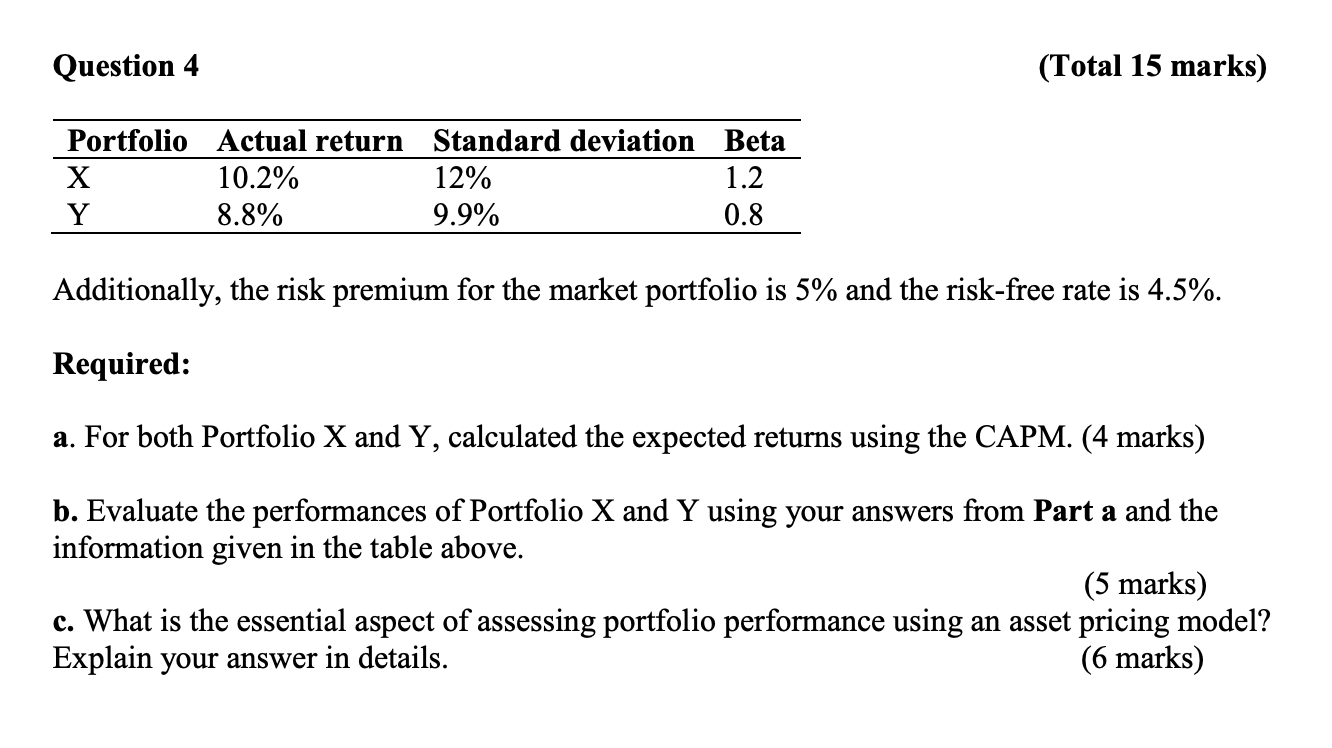

Question 4 (Total 15 marks) Portfolio Actual return Standard deviation Beta X 10.2% 12% 1.2 Y 8.8% 9.9% 0.8 Additionally, the risk premium for the market portfolio is 5% and the risk-free rate is 4.5%. Required: a. For both Portfolio X and Y, calculated the expected returns using the CAPM. (4 marks) b. Evaluate the performances of Portfolio X and Y using your answers from Part a and the information given in the table above. (5 marks) c. What is the essential aspect of assessing portfolio performance using an asset pricing model? Explain your answer in details. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts