Question: Question 4 (Total 20 marks) Using a maximum of 20 lines per question, address the following two questions. (Please note that everything beyond the line

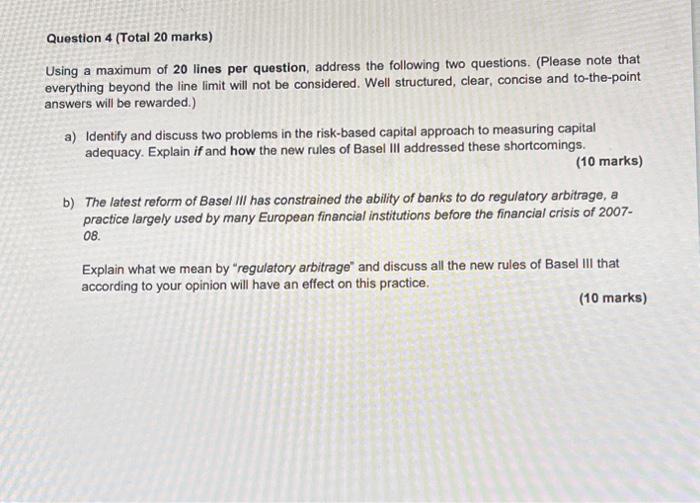

Question 4 (Total 20 marks) Using a maximum of 20 lines per question, address the following two questions. (Please note that everything beyond the line limit will not be considered. Well structured, clear, concise and to-the-point answers will be rewarded.) a) Identify and discuss two problems in the risk-based capital approach to measuring capital adequacy. Explain if and how the new rules of Basel III addressed these shortcomings. (10 marks) b) The latest reform of Basel III has constrained the ability of banks to do regulatory arbitrage, a practice largely used by many European financial institutions before the financial crisis of 2007 08. Explain what we mean by "regulatory arbitrage" and discuss all the new rules of Basel III that according to your opinion will have an effect on this practice. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts