Question: Question 4 (TOTAL: 20 points) Your research has found that the returns of all securities in the economy share oil price as one common factor

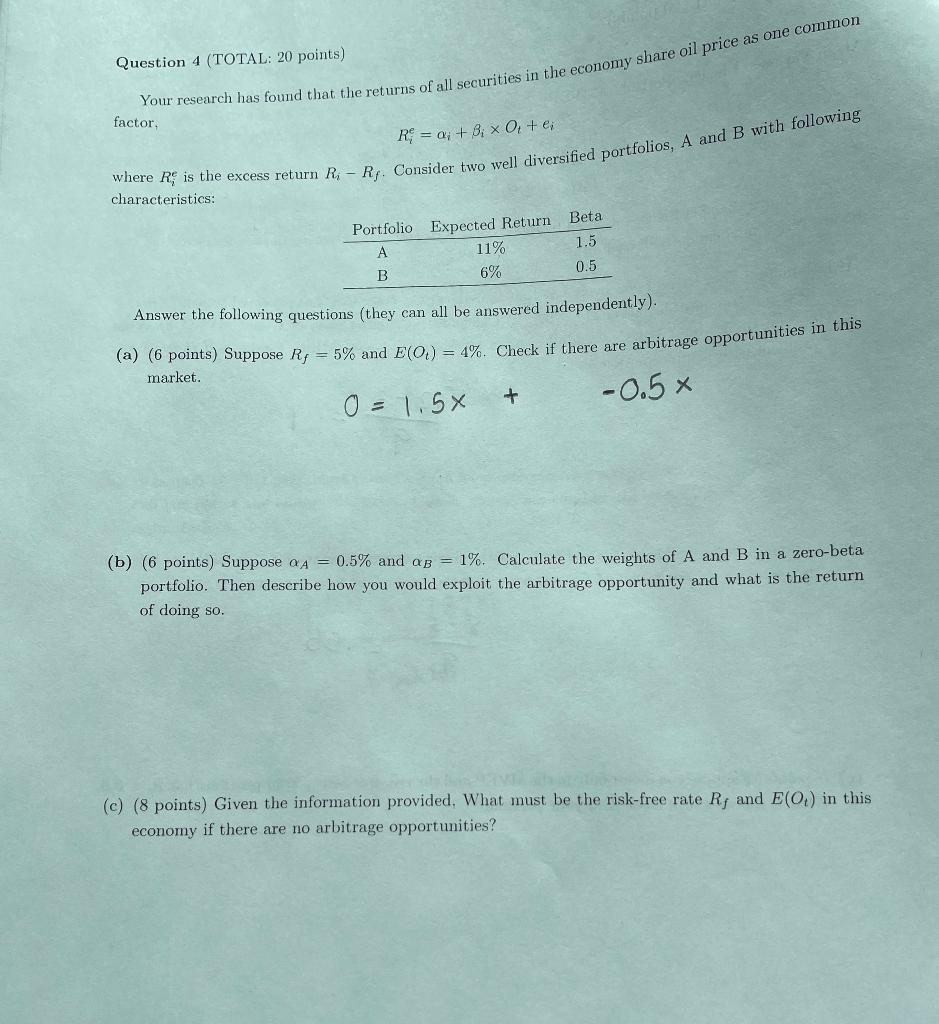

Question 4 (TOTAL: 20 points) Your research has found that the returns of all securities in the economy share oil price as one common factor R = 0; + Bi x 0, +e; where R is the excess return Ri - Rp. Consider two well diversified portfolios, A and B with following characteristics: Beta 1.5 0.5 A Portfolio Expected Return 11% B 6% Answer the following questions (they can all be answered independently). (a) (6 points) Suppose Rs = 5% and E(0) = 4%. Check if there are arbitrage opportunities in this market. 0 = 1.58 + -0.5x (b) (6 points) Suppose a A = 0.5% and ab = 1%. Calculate the weights of A and B in a zero-beta portfolio. Then describe how you would exploit the arbitrage opportunity and what is the return of doing so. (c) (8 points) Given the information provided. What must be the risk-free rate R, and E(0) in this economy if there are no arbitrage opportunities? Question 4 (TOTAL: 20 points) Your research has found that the returns of all securities in the economy share oil price as one common factor R = 0; + Bi x 0, +e; where R is the excess return Ri - Rp. Consider two well diversified portfolios, A and B with following characteristics: Beta 1.5 0.5 A Portfolio Expected Return 11% B 6% Answer the following questions (they can all be answered independently). (a) (6 points) Suppose Rs = 5% and E(0) = 4%. Check if there are arbitrage opportunities in this market. 0 = 1.58 + -0.5x (b) (6 points) Suppose a A = 0.5% and ab = 1%. Calculate the weights of A and B in a zero-beta portfolio. Then describe how you would exploit the arbitrage opportunity and what is the return of doing so. (c) (8 points) Given the information provided. What must be the risk-free rate R, and E(0) in this economy if there are no arbitrage opportunities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts