Question: QUESTION 4 Total 9 marks Suppose there are three independent factors (F1, F2 and F3) in a multifactor Arbitrage Pricing Theory (APT) model of security

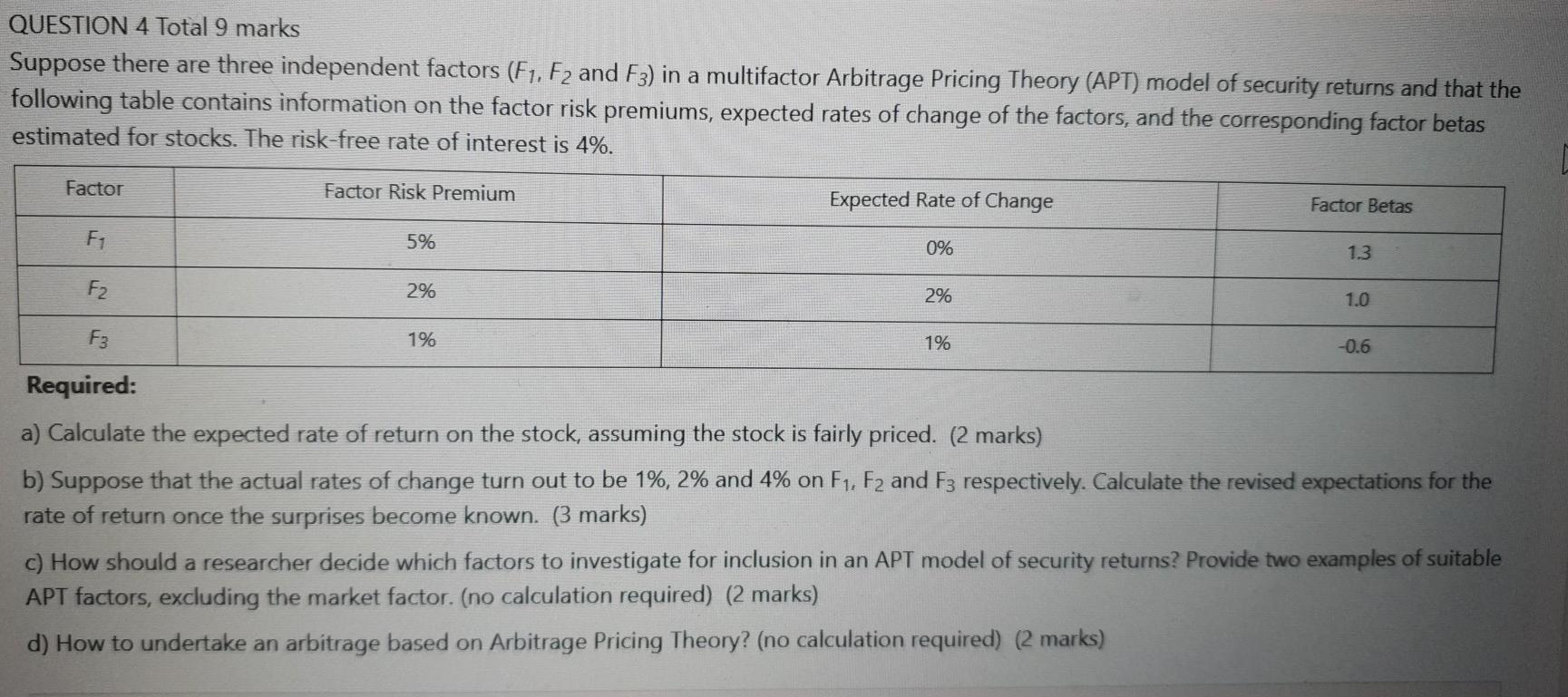

QUESTION 4 Total 9 marks Suppose there are three independent factors (F1, F2 and F3) in a multifactor Arbitrage Pricing Theory (APT) model of security returns and that the following table contains information on the factor risk premiums, expected rates of change of the factors, and the corresponding factor betas estimated for stocks. The risk-free rate of interest is 4%. Factor Factor Risk Premium Expected Rate of Change Factor Betas F1 5% 0% 1.3 F2 2% 2% 1.0 F3 1% 1% -0.6 Required: a) Calculate the expected rate of return on the stock, assuming the stock is fairly priced. (2 marks) b) Suppose that the actual rates of change turn out to be 1%, 2% and 4% on F1, F2 and F3 respectively. Calculate the revised expectations for the rate of return once the surprises become known. (3 marks) c) How should a researcher decide which factors to investigate for inclusion in an APT model of security returns? Provide two examples of suitable APT factors, excluding the market factor. (no calculation required) (2 marks) d) How to undertake an arbitrage based on Arbitrage Pricing Theory? (no calculation required) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts