Question: Question 4 : Traditional Costing Versus Activity Based Costing ( 2 8 marks ) Deadly Drop Down Ltd . ( DDD ) assembles and sells

Question : Traditional Costing Versus Activity Based Costing marks

Deadly Drop Down LtdDDD assembles and sells two types of climbing harness the Trad and the Sport. The company has two production divisions: assembly and finishing.

You have obtained the following information from the last month about the two products:

tableTrad,SportProduction and sales unitsCosts per unit:Materials DM$$Labour $ per hour DL $$$Machine hours per unitTotal number of production runs,Total number of machine maintenance checks,Total number of quality control checks,Total purchase orders processed,Total number of deliveries to finishing division,Overhead costs to manufacture all Trads and Sports:,$Machine setup costs,$Machine maintenance costs, $Quality Inspection costs $ $ A Ordering costs, $Delivery costs,

Further information:

The company transfers products from assembly to finishing at full cost plus A traditional total absorption costing approach is currently used based on labour hours.

The retail division sells the products directly to the public at the following prices: harnesses for $; Sport harnesses for $

The senior manager of the retail division thinks that the current costing system leads to an overinflation of the prices her division is being charged. She believes that a costing system based on either a machine hours or b activities, would be fairer.Required

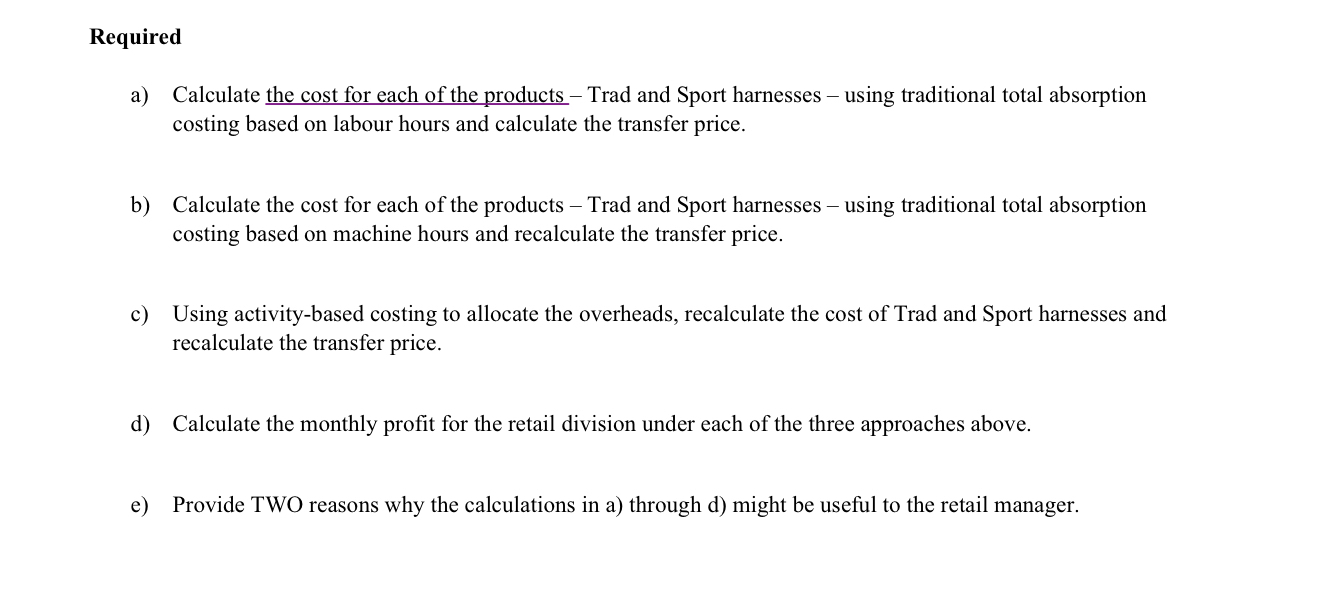

a Calculate the cost for each of the products Trad and Sport harnesses using traditional total absorption costing based on labour hours and calculate the transfer price.

b Calculate the cost for each of the products Trad and Sport harnesses using traditional total absorption costing based on machine hours and recalculate the transfer price.

c Using activitybased costing to allocate the overheads, recalculate the cost of Trad and Sport harnesses and recalculate the transfer price.

d Calculate the monthly profit for the retail division under each of the three approaches above.

e Provide TWO reasons why the calculations in a through d might be useful to the retail manager.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock