Question: Question 4: (Tutor) A. Dynamic Laundry Services provides the following information in relation to assets purchased mainly to use in the business: Asset Purchase Date

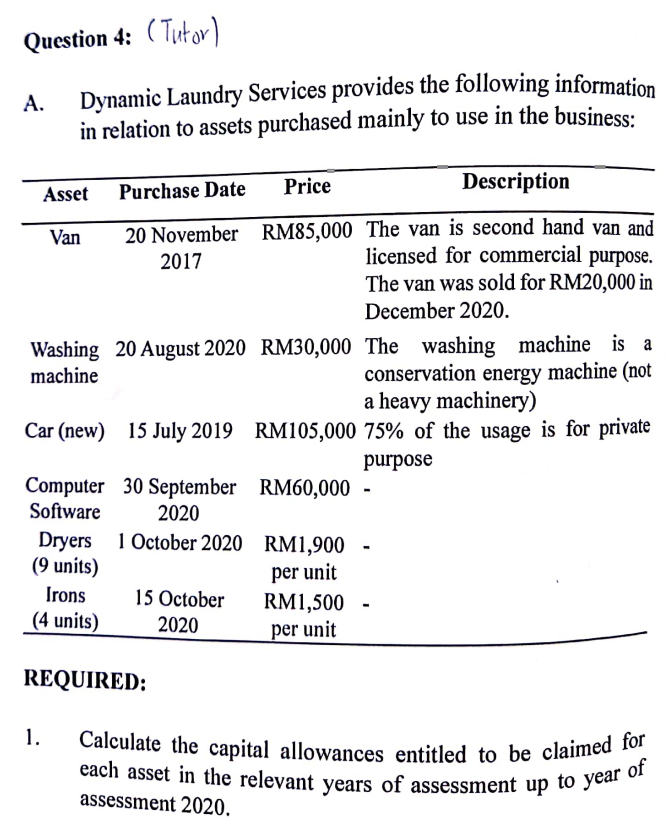

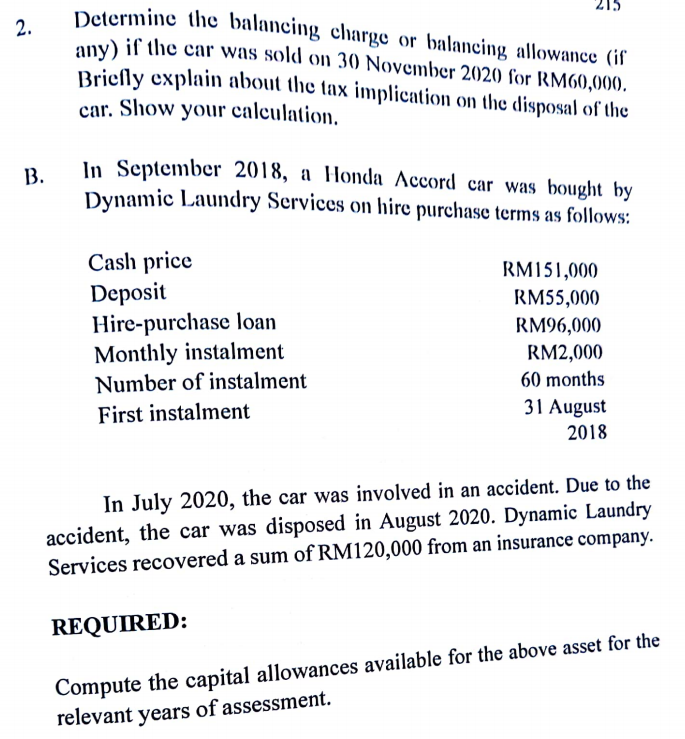

Question 4: (Tutor) A. Dynamic Laundry Services provides the following information in relation to assets purchased mainly to use in the business: Asset Purchase Date Description Price Van 20 November RM85,000 The van is second hand van and 2017 licensed for commercial purpose. The van was sold for RM20,000 in December 2020. Washing 20 August 2020 RM30,000 The washing machine is a machine conservation energy machine (not a heavy machinery) Car (new) 15 July 2019 RM105,000 75% of the usage is for private purpose Computer 30 September RM60,000 Software 2020 Dryers 1 October 2020 RM1,900 (9 units) Irons 15 October RM1,500 - (4 units) 2020 per unit per unit REQUIRED: 1. Calculate the capital allowances entitled to be claimed for each asset in the relevant years of assessment up to year of assessment 2020. 215 2. Determine the balancing charge or balancing allowance (if any) if the car was sold on 30 November 2020 for RM60,000) . Briefly explain about the tax implication on the disposal of the car. Show your calculation. B. In September 2018, a Honda Accord car was bought by Dynamic Laundry Services on hire purchase terms as follows: Cash price Deposit Hire-purchase loan Monthly instalment Number of instalment First instalment RM151,000 RM55,000 RM96,000 RM2,000 60 months 31 August 2018 In July 2020, the car was involved in an accident. Due to the accident, the car was disposed in August 2020. Dynamic Laundry Services recovered a sum of RM120,000 from an insurance company. REQUIRED: Compute the capital allowances available for the above asset for the relevant years of assessment. Question 4: (Tutor) A. Dynamic Laundry Services provides the following information in relation to assets purchased mainly to use in the business: Asset Purchase Date Description Price Van 20 November RM85,000 The van is second hand van and 2017 licensed for commercial purpose. The van was sold for RM20,000 in December 2020. Washing 20 August 2020 RM30,000 The washing machine is a machine conservation energy machine (not a heavy machinery) Car (new) 15 July 2019 RM105,000 75% of the usage is for private purpose Computer 30 September RM60,000 Software 2020 Dryers 1 October 2020 RM1,900 (9 units) Irons 15 October RM1,500 - (4 units) 2020 per unit per unit REQUIRED: 1. Calculate the capital allowances entitled to be claimed for each asset in the relevant years of assessment up to year of assessment 2020. 215 2. Determine the balancing charge or balancing allowance (if any) if the car was sold on 30 November 2020 for RM60,000) . Briefly explain about the tax implication on the disposal of the car. Show your calculation. B. In September 2018, a Honda Accord car was bought by Dynamic Laundry Services on hire purchase terms as follows: Cash price Deposit Hire-purchase loan Monthly instalment Number of instalment First instalment RM151,000 RM55,000 RM96,000 RM2,000 60 months 31 August 2018 In July 2020, the car was involved in an accident. Due to the accident, the car was disposed in August 2020. Dynamic Laundry Services recovered a sum of RM120,000 from an insurance company. REQUIRED: Compute the capital allowances available for the above asset for the relevant years of assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts