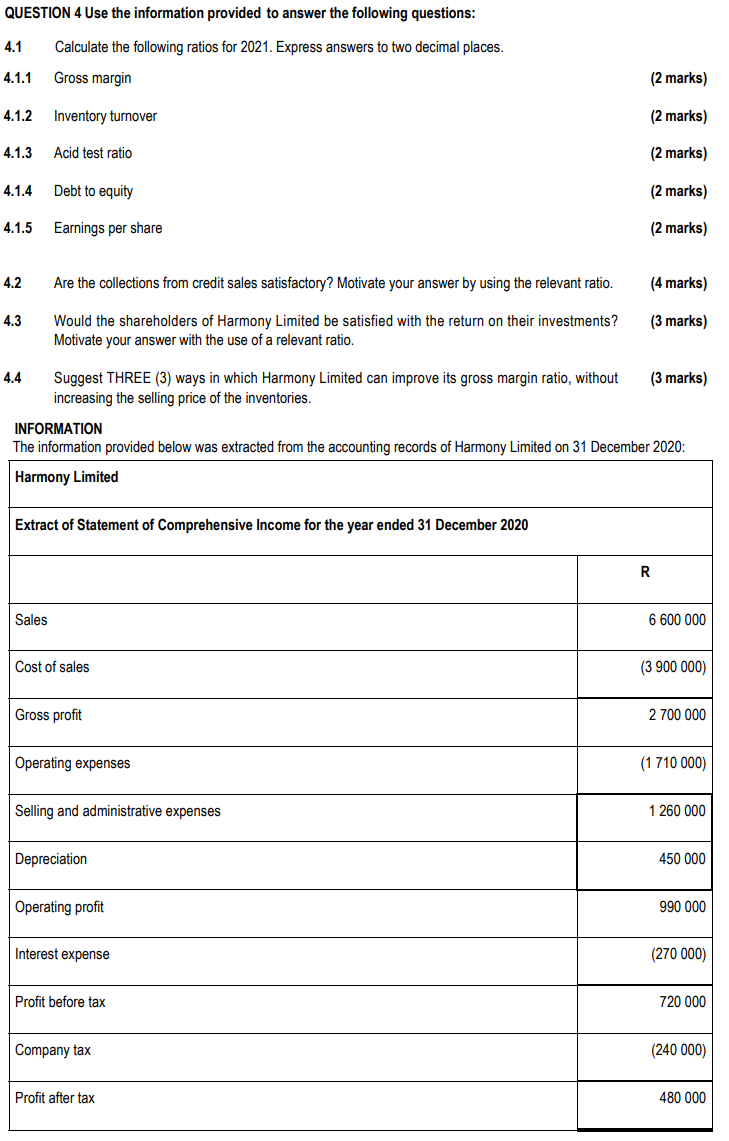

Question: QUESTION 4 Use the information provided to answer the following questions: 4.1 Calculate the following ratios for 2021. Express answers to two decimal places.

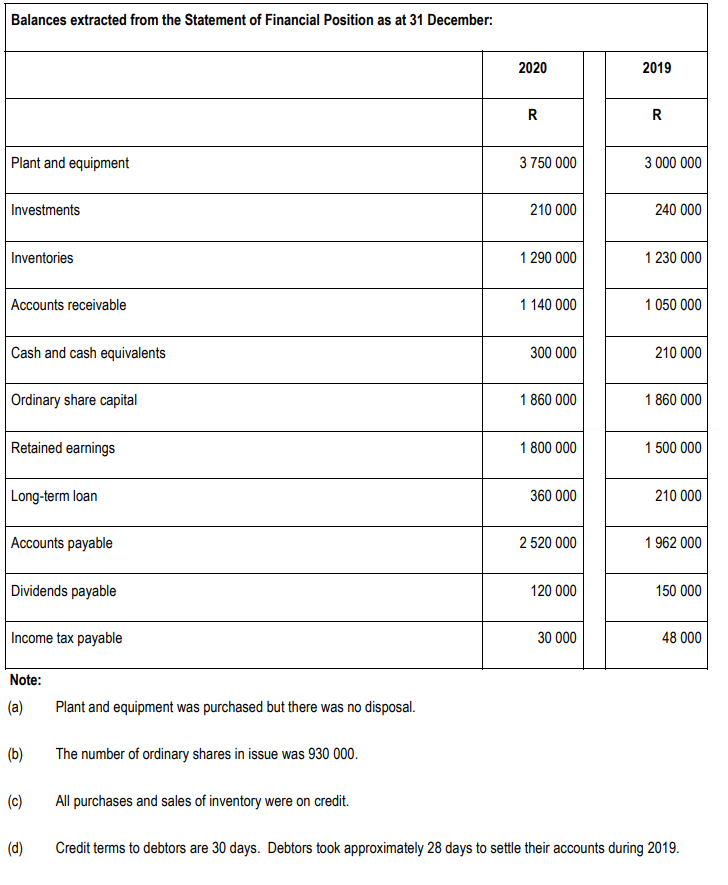

QUESTION 4 Use the information provided to answer the following questions: 4.1 Calculate the following ratios for 2021. Express answers to two decimal places. 4.1.1 Gross margin 4.1.2 Inventory turnover 4.1.3 4.1.4 4.1.5 4.2 4.3 4.4 Acid test ratio Debt to equity Earnings per share Sales Are the collections from credit sales satisfactory? Motivate your answer by using the relevant ratio. Would the shareholders of Harmony Limited be satisfied with the return on their investments? Motivate your answer with the use of a relevant ratio. Suggest THREE (3) ways in which Harmony Limited can improve its gross margin ratio, without increasing the selling price of the inventories. Extract of Statement of Comprehensive Income for the year ended 31 December 2020 INFORMATION The information provided below was extracted from the accounting records of Harmony Limited on 31 December 2020: Harmony Limited Cost of sales Gross profit Operating expenses Selling and administrative expenses Depreciation Operating profit Interest expense Profit before tax Company tax (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) Profit after tax (4 marks) (3 marks) (3 marks) R 6 600 000 (3 900 000) 2 700 000 (1 710 000) 1 260 000 450 000 990 000 (270 000) 720 000 (240 000) 480 000 Balances extracted from the Statement of Financial Position as at 31 December: Plant and equipment Investments Inventories Accounts receivable Cash and cash equivalents Ordinary share capital Retained earnings Long-term loan Accounts payable Dividends payable Income tax payable Note: (a) (b) (c) (d) Plant and equipment was purchased but there was no disposal. The number of ordinary shares in issue was 930 000. All purchases and sales of inventory were on credit. 2020 R 3 750 000 210 000 1 290 000 1 140 000 300 000 1 860 000 1 800 000 360 000 2 520 000 120 000 30 000 2019 R 3 000 000 240 000 1 230 000 1 050 000 210 000 1 860 000 1 500 000 210 000 1 962 000 150 000 48 000 Credit terms to debtors are 30 days. Debtors took approximately 28 days to settle their accounts during 2019.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts