Question: Question 4: Using similar concepts on call on a stock, one can consider buying a 3-month call on a 10-Y Treasury bond. Which of the

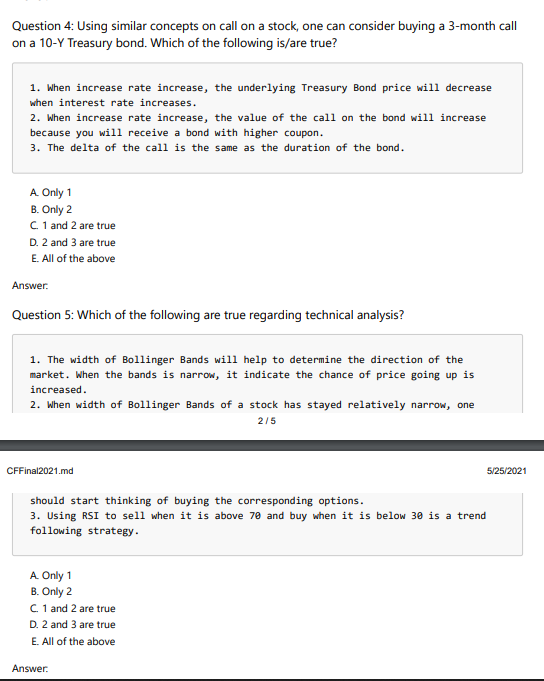

Question 4: Using similar concepts on call on a stock, one can consider buying a 3-month call on a 10-Y Treasury bond. Which of the following is/are true? 1. When increase rate increase, the underlying Treasury Bond price will decrease when interest rate increases. 2. When increase rate increase, the value of the call on the bond will increase because you will receive a bond with higher coupon. 3. The delta of the call is the same as the duration of the bond. A Only 1 B. Only 2 C 1 and 2 are true D. 2 and 3 are true E. All of the above Answer. Question 5: Which of the following are true regarding technical analysis? 1. The width of Bollinger Bands will help to determine the direction of the market. When the bands is narrow, it indicate the chance of price going up is increased 2. When width of Bollinger Bands of a stock has stayed relatively narrow, one 2/5 CFFinal2021.md 5/25/2021 should start thinking of buying the corresponding options. 3. Using RSI to sell when it is above 70 and buy when it is below 30 is a trend following strategy A Only 1 B. Only 2 C. 1 and 2 are true D. 2 and 3 are true E. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts