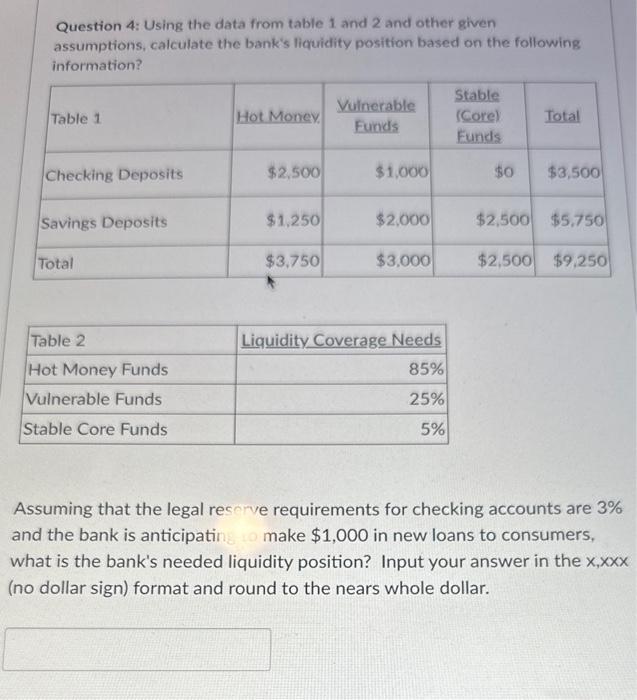

Question: Question 4: Using the data from table 1 and 2 and other given assumptions, calculate the bank's liquidity position based on the following information? Assuming

Question 4: Using the data from table 1 and 2 and other given assumptions, calculate the bank's liquidity position based on the following information? Assuming that the legal resorve requirements for checking accounts are 3% and the bank is anticipatin make $1,000 in new loans to consumers, what is the bank's needed liquidity position? Input your answer in the x,xxX (no dollar sign) format and round to the nears whole dollar. Question 4: Using the data from table 1 and 2 and other given assumptions, calculate the bank's liquidity position based on the following information? Assuming that the legal resorve requirements for checking accounts are 3% and the bank is anticipatin make $1,000 in new loans to consumers, what is the bank's needed liquidity position? Input your answer in the x,xxX (no dollar sign) format and round to the nears whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts