Question: Question 4 - Valuing a Swap (6 marks) Two years ago, a company and a counterparty agreed to a $100 million 5-year swap with the

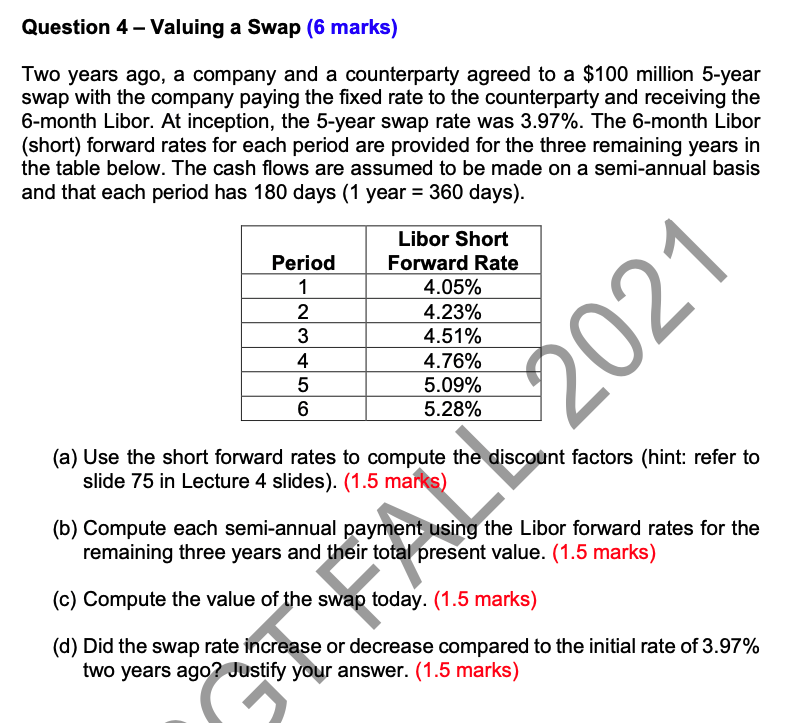

Question 4 - Valuing a Swap (6 marks) Two years ago, a company and a counterparty agreed to a $100 million 5-year swap with the company paying the fixed rate to the counterparty and receiving the 6-month Libor. At inception, the 5-year swap rate was 3.97%. The 6-month Libor (short) forward rates for each period are provided for the three remaining years in the table below. The cash flows are assumed to be made on a semi-annual basis and that each period has 180 days (1 year = 360 days). Period 1 2 3 4 5 6 WIN Libor Short Forward Rate 4.05% 4.23% 4.51% 4.76% 5.09% 5.28% 2021 (a) Use the short forward rates to compute the discount factors (hint: refer to slide 75 in Lecture 4 slides). (1.5 marks) (b) Compute each semi-annual payment using the Libor forward rates for the remaining three years and their total present value. (1.5 marks) (c) Compute the value of the swap today. (1.5 marks) (d) Did the swap rate increase or decrease compared to the initial rate of 3.97% two years ago? Justify your answer. (1.5 marks) Question 4 - Valuing a Swap (6 marks) Two years ago, a company and a counterparty agreed to a $100 million 5-year swap with the company paying the fixed rate to the counterparty and receiving the 6-month Libor. At inception, the 5-year swap rate was 3.97%. The 6-month Libor (short) forward rates for each period are provided for the three remaining years in the table below. The cash flows are assumed to be made on a semi-annual basis and that each period has 180 days (1 year = 360 days). Period 1 2 3 4 5 6 WIN Libor Short Forward Rate 4.05% 4.23% 4.51% 4.76% 5.09% 5.28% 2021 (a) Use the short forward rates to compute the discount factors (hint: refer to slide 75 in Lecture 4 slides). (1.5 marks) (b) Compute each semi-annual payment using the Libor forward rates for the remaining three years and their total present value. (1.5 marks) (c) Compute the value of the swap today. (1.5 marks) (d) Did the swap rate increase or decrease compared to the initial rate of 3.97% two years ago? Justify your answer. (1.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts