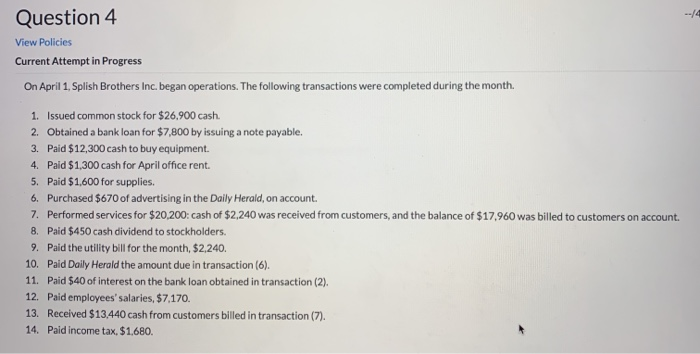

Question: Question 4 View Policies Current Attempt in Progress On April 1, Splish Brothers Inc. began operations. The following transactions were completed during the month. 1.

Question 4 View Policies Current Attempt in Progress On April 1, Splish Brothers Inc. began operations. The following transactions were completed during the month. 1. Issued common stock for $26,900 cash. 2. Obtained a bank loan for $7,800 by issuing a note payable. 3. Paid $12,300 cash to buy equipment. 4. Paid $1,300 cash for April office rent. 5. Paid $1,600 for supplies. 6. Purchased $670 of advertising in the Daily Herald, on account. 7. Performed services for $20,200: cash of $2,240 was received from customers, and the balance of $17,960 was billed to customers on account 8. Paid $450 cash dividend to stockholders. 9. Paid the utility bill for the month, $2,240. 10. Paid Daily Herald the amount due in transaction (6). 11. Paid $40 of interest on the bank loan obtained in transaction (2) 12. Paid employees' salaries, $7,170. 13. Received $13.440 cash from customers billed in transaction (7). 14. Paid income tax. $1,680. Journalize the transactions. (If no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit 1. 2. 3. 4. 5. 6. I N 8. 9. 10. 11. 12. 10. 11. 12. 13. 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts