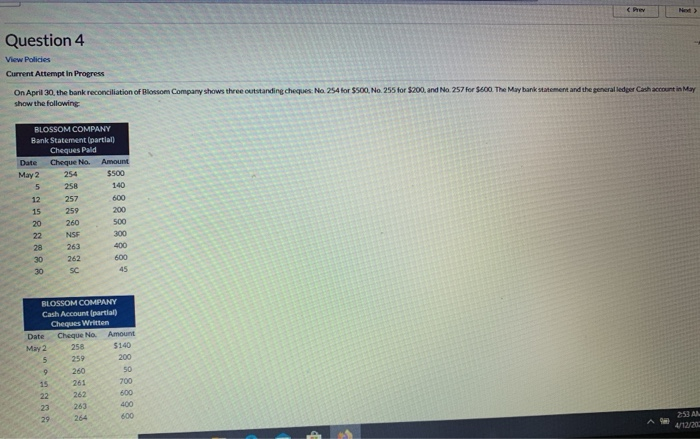

Question: Question 4 View Policies Current Attempt in Progress On April 30, the bank reconciliation of Bloom Company shows three outstanding cheques No 254 for $SOQ,

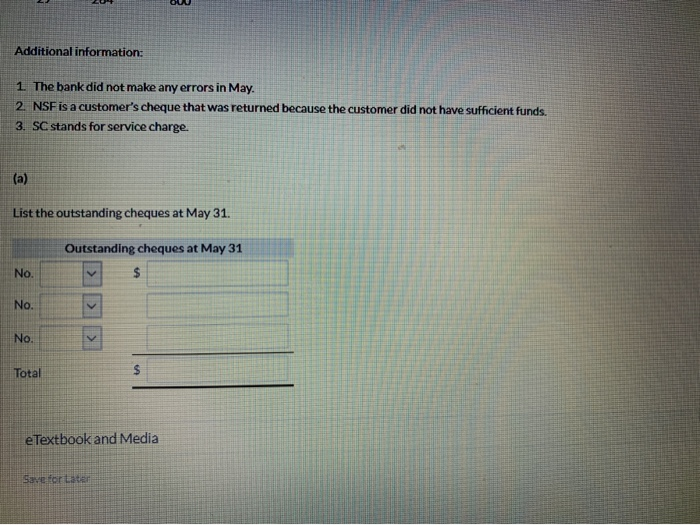

Question 4 View Policies Current Attempt in Progress On April 30, the bank reconciliation of Bloom Company shows three outstanding cheques No 254 for $SOQ, No. 255 for $200, and No 257 for $600. The Maybank statement and the general leder Cachacunt in May show the following BLOSSOM COMPANY Bank Statement partial Cheques Pald Date Cheque No Amount May 2 254 $500 258 257 260 SANSRR NSE RLOSSOM COMPANY Cash Account partial Cheques Written Date Cheque No Amount 2 258 $140 259 260 BORG Additional information: 1. The bank did not make any errors in May. 2. NSF is a customer's cheque that was returned because the customer did not have sufficient funds. 3. SC stands for service charge. List the outstanding cheques at May 31. Outstanding cheques at May 31 No. No. No. Total eTextbook and Media Save for Late

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts