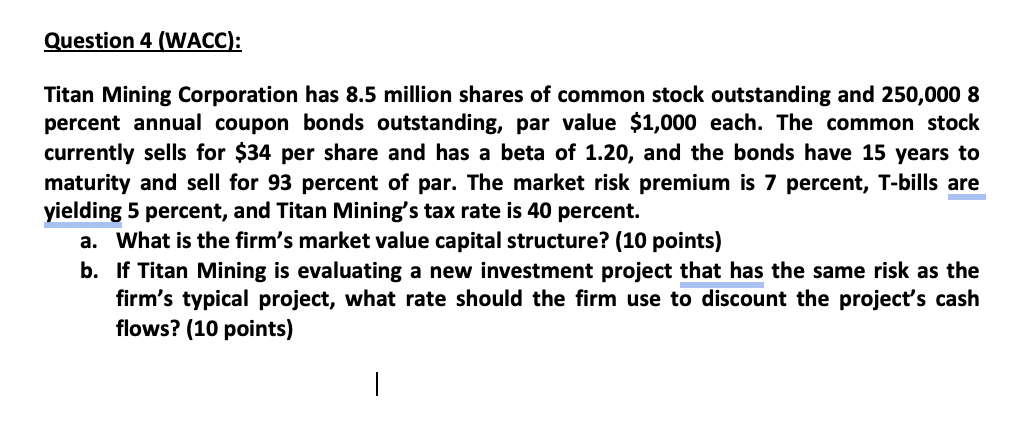

Question: Question 4 ( WACC ) : Titan Mining Corporation has 8 . 5 million shares of common stock outstanding and 2 5 0 , 0

Question WACC: Titan Mining Corporation has million shares of common stock outstanding and percent annual coupon bonds outstanding, par value $ each. The common stock currently sells for $ per share and has a beta of and the bonds have years to maturity and sell for percent of par. The market risk premium is percent, Tbills are yielding percent, and Titan Mining's tax rate is mathbf percent. a What is the firm's market value capital structure? points b If Titan Mining is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock