Question: question 4 was marked wrong, but idk why Astro Co. sold 19,700 units of its only product and incurred a $59,290 loss (ignoring taxes) for

question 4 was marked wrong, but idk why

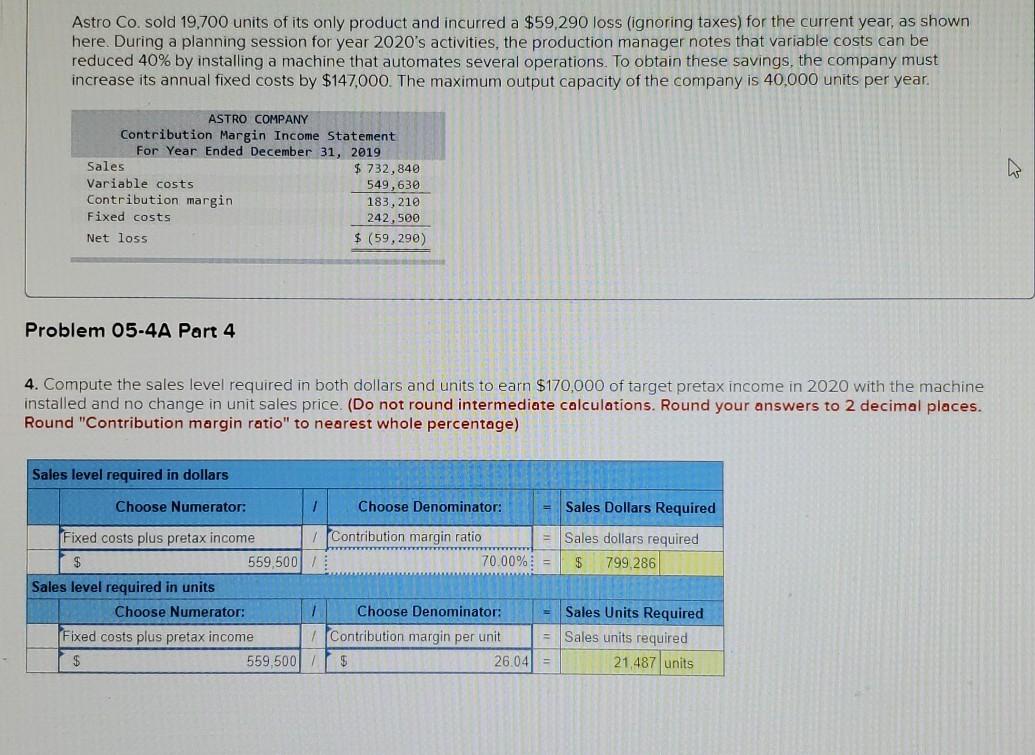

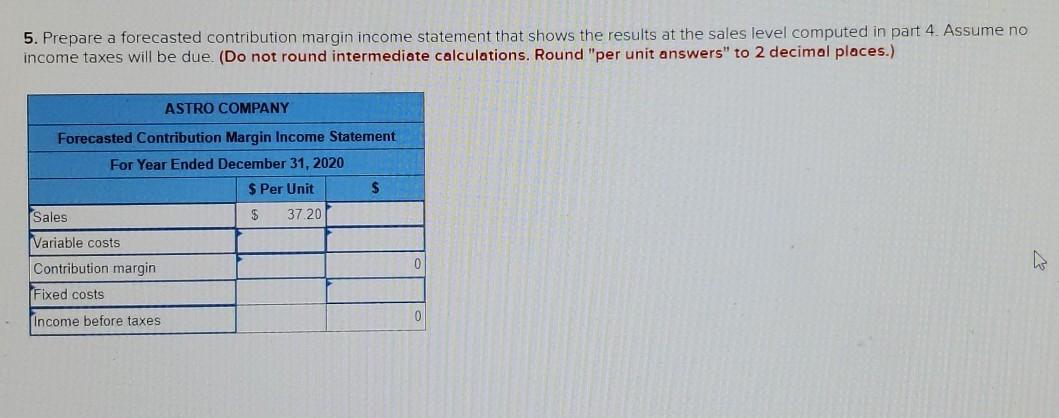

Astro Co. sold 19,700 units of its only product and incurred a $59,290 loss (ignoring taxes) for the current year, as shown here. During a planning session for year 2020's activities, the production manager notes that variable costs can be reduced 40% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $147,000. The maximum output capacity of the company is 40,000 units per year. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31, 2019 Sales $ 732,840 Variable costs 549,630 Contribution margin 183,210 Fixed costs 242,500 Net loss $ (59,290) Problem 05-4A Part 4 4. Compute the sales level required in both dollars and units to earn $170,000 of target pretax income in 2020 with the machine installed and no change in unit sales price. (Do not round intermediate calculations. Round your answers to 2 decimal places. Round "Contribution margin ratio" to nearest whole percentage) Sales level required in dollars Choose Numerator: 1 Choose Denominator: Sales Dollars Required Sales dollars required $ 799,286 Fixed costs plus pretax income Contribution margin ratio $ 559,500 / 70.00% = Sales level required in units Choose Numerator: 1 Choose Denominator: Fixed costs plus pretax income Contribution margin per unit $ 559,500 $ 26.04 = Sales Units Required Sales units required 21.487 units 5. Prepare a forecasted contribution margin income statement that shows the results at the sales level computed in part 4 Assume no income taxes will be due (Do not round intermediate calculations. Round "per unit answers" to 2 decimal places.) ASTRO COMPANY Forecasted Contribution Margin Income Statement For Year Ended December 31, 2020 $ Per Unit $ Sales $ 37.20 Variable costs Contribution margin 0 Fixed costs 0 Income before taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts