Question: Question 4 You are designing rollfonrvard procedures for your audit client Best Computers, Inc. Best Computers, Inc. has a year-end of 31 December and historically,

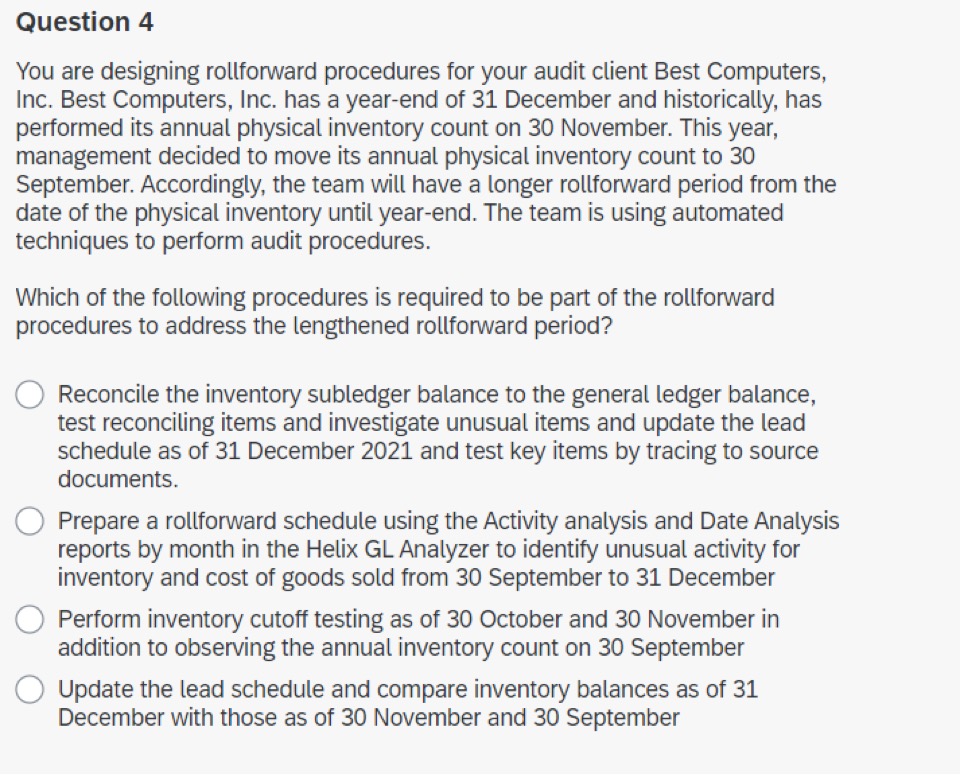

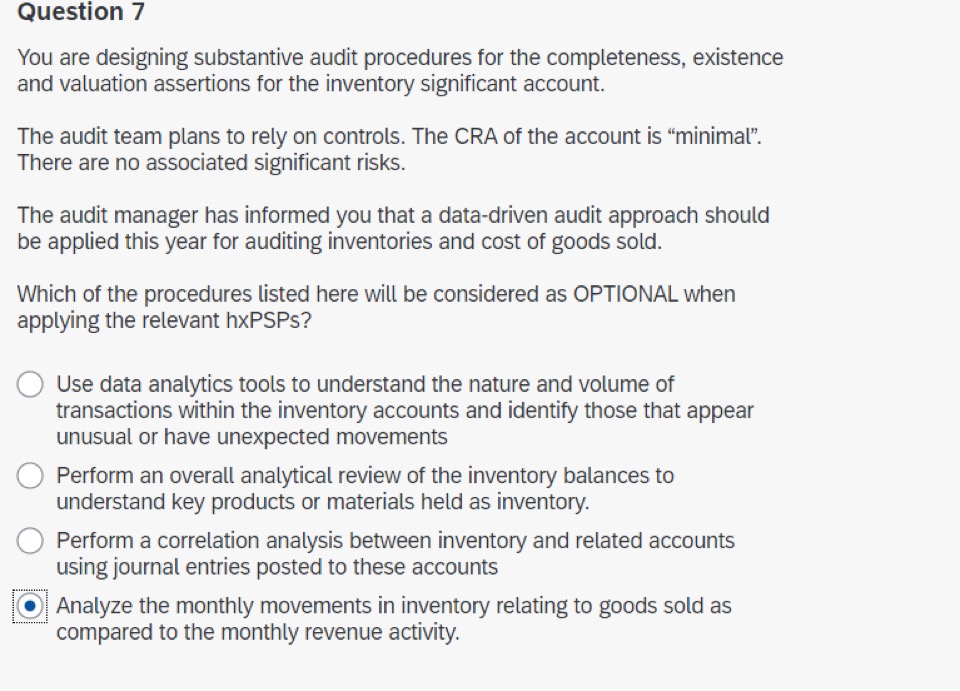

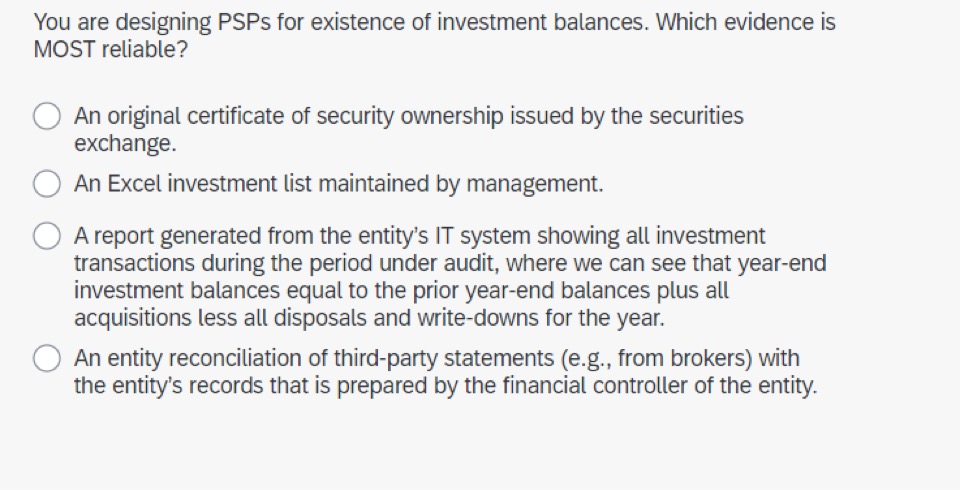

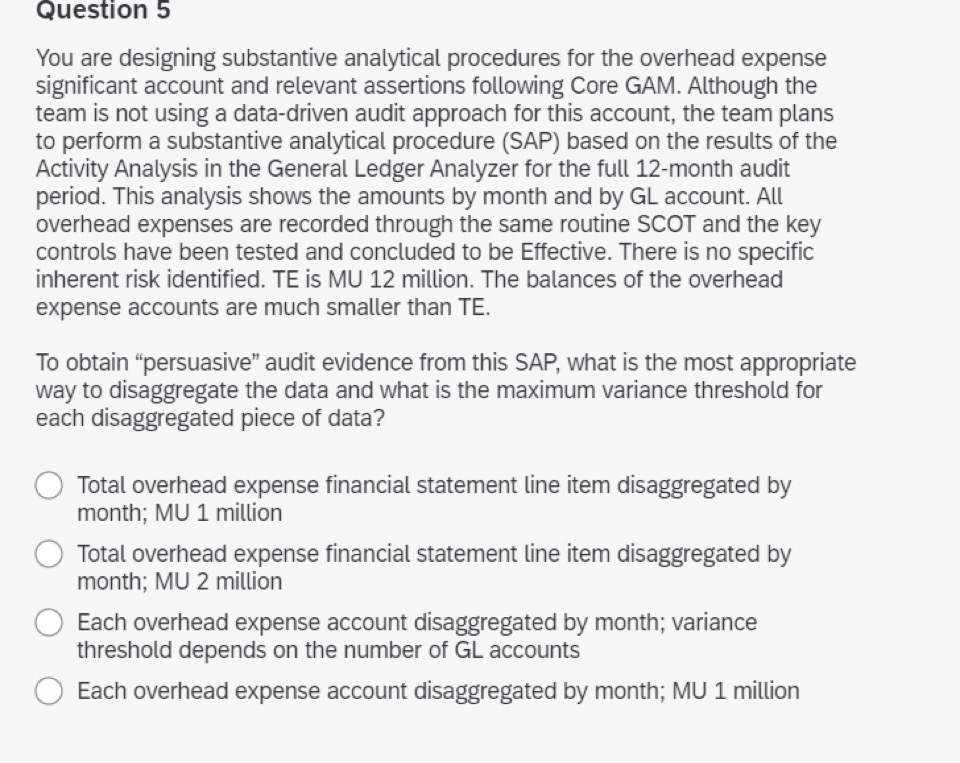

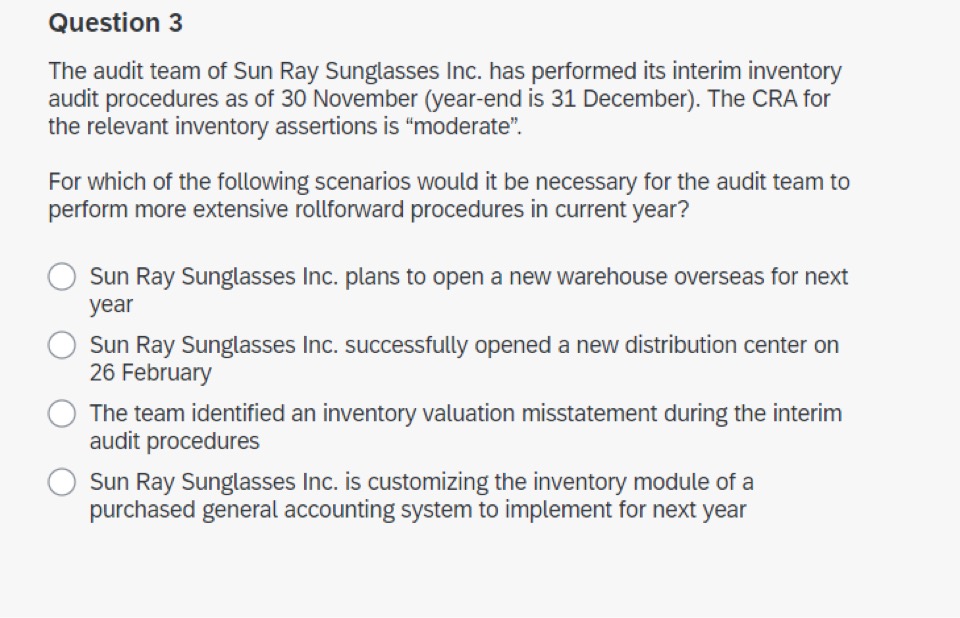

Question 4 You are designing rollfonrvard procedures for your audit client Best Computers, Inc. Best Computers, Inc. has a year-end of 31 December and historically, has performed its annual physical inventory count on 30 November. This year, management decided to move its annual physical inventory count to 30 September. Accordingly, the team will have a longer rollforward period from the date of the physical inventory until year-end. The team is using automated techniques to perform audit procedures. Which of the following procedures is required to be part of the rollforward procedures to address the lengthened rollfonvard period? 0 Reconcile the inventory subledger balance to the general ledger balance, test reconciling items and investigate unusual items and update the lead schedule as of 31 December 2021 and test key items by tracing to source documents. 0 Prepare a rollforward schedule using the Activity analysis and Date Analysis reports by month in the Helix GL Analyzer to identify unusual activity for inventory and cost of goods sold from 30 September to 31 December O Perform inventory cutoff testing as of 30 October and 30 November in addition to observing the annual inventory count on 30 September 0 Update the lead schedule and compare inventory balances as of 31 December with those as of 30 November and 30 September Question 7 You are designing substantive audit procedures for the completeness, existence and valuation assertions for the inventory significant account. The audit team plans to rely on controls. The CRA of the account is "minimal". There are no associated signicant risks. The audit manager has informed you that a data-driven audit approach should be applied this year for auditing inventories and cost of goods sold. Which of the procedures listed here will be considered as OPTIONAL when applying the relevant thSPs? O Use data analytics tools to understand the nature and volume of transactions within the inventory accounts and identify those that appear unusual or have unexpected movements 0 Perform an overall analytical review of the inventory balances to understand key products or materials held as inventory. O Perform a correlation analysis between inventory and related accounts using journal entries posted to these accounts H Analyze the monthly movements in inventoly relating to goods sold as """"""" compared to the monthly revenue activity. You are designing PSPs for existence of investment balances. Which evidence is MOST reliable? C) An original certificate of security ownership issued by the securities exchange. 0 An Excel investment list maintained by management. 0 A report generated from the entity's IT system showing all investment transactions during the period under audit, where we can see that year-end investment balances equal to the prior year-end balances plus all acquisitions less all disposals and writedowns for the year. 0 An entity reconciliation of third-party statements (e.g.. from brokers) with the entity's records that is prepared by the nancial controller of the entity. Question 5 You are designing substantive analytical procedures for the overhead expense signicant account and relevant assertions following Core GAM. Although the team is not using a data-driven audit approach for this account, the team plans to perform a substantive analytical procedure (SAP) based on the results of the Activity Analysis in the General Ledger Analyzer for the full 12-month audit period. This analysis shows the amounts by month and by GL account. All overhead expenses are recorded through the same routine SCOT and the key controls have been tested and concluded to be Effective. There is no specific inherent risk identified. TE is MU 12 million. The balances of the overhead expense accounts are much smaller than TE. To obtain \"persuasive\" audit evidence from this SAP, what is the most appropriate way to disaggregate the data and what is the maximum variance threshold for each disaggregated piece of data? C) Total overhead expense nancial statement line item disaggregated by month; MU 1 million 0 Total ovemead expense nancial statement line item disaggregated by month; MU 2 million 0 Each overhead expense account disaggregated by month; variance threshold depends on the number of GL accounts 0 Each overhead expense account disaggregated by month; MU 1 million Question 3 The audit team of Sun Ray Sunglasses Inc. has performed its interim inventory audit procedures as of 30 November (year-end is 31 December). The CRA for the relevant inventory assertions is \"moderate\". For which of the following scenarios would it be necessary for the audit team to perform more extensive rollforward procedures in current year? Q Sun Ray Sunglasses Inc. plans to open a new warehouse overseas for next year C) Sun Ray Sunglasses Inc. successfully opened a new distribution center on 26 February O The team identified an inventory valuation misstatement during the interim audit procedures C) Sun Ray Sunglasses Inc. is customizing the inventory module of a purchased general accounting system to implement for next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts