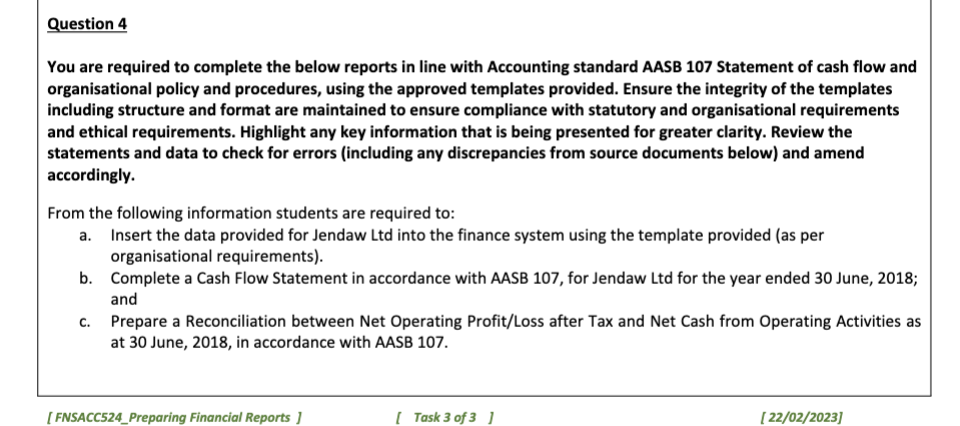

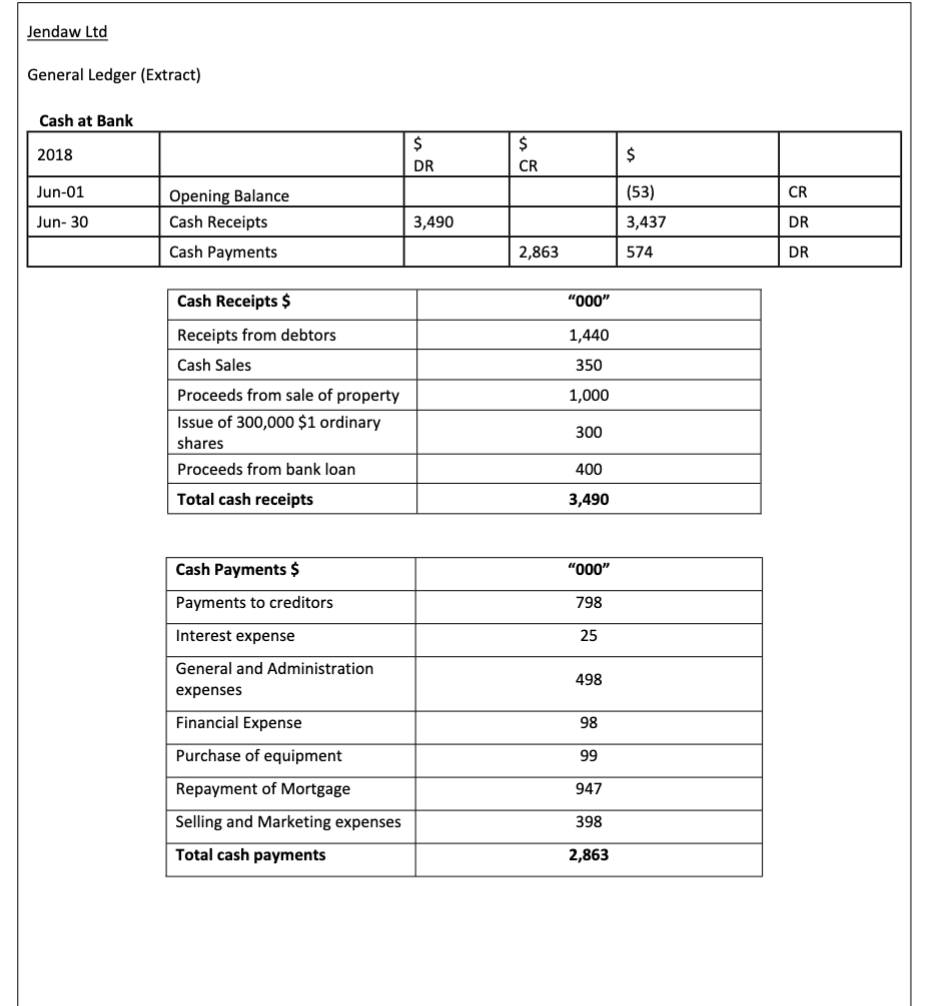

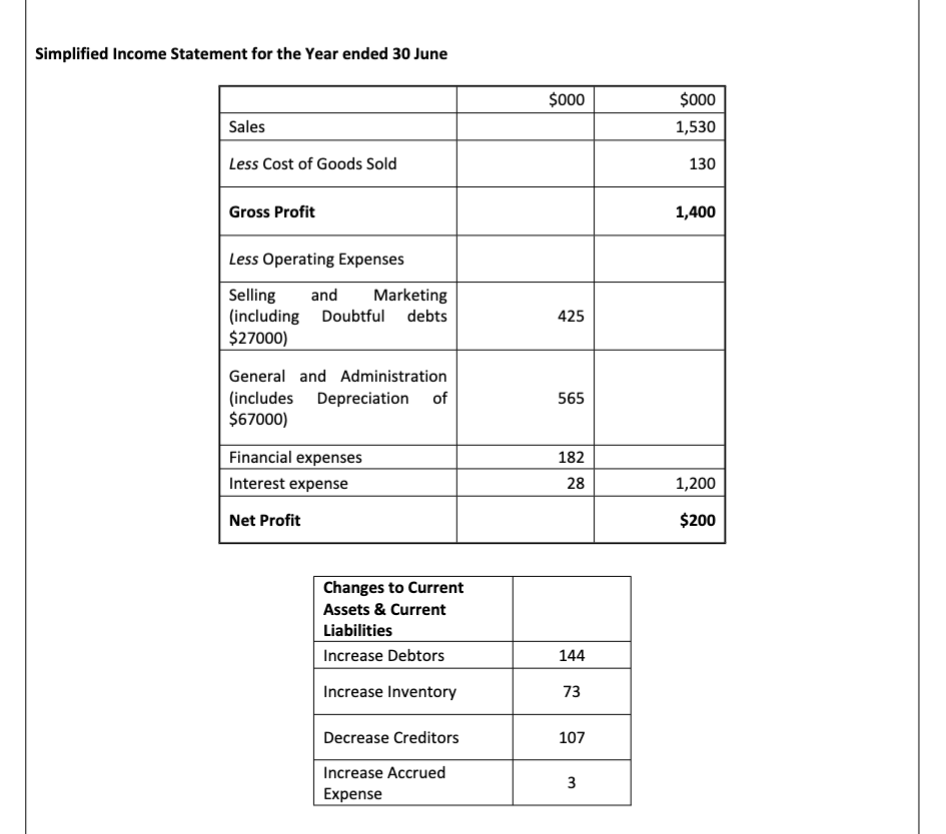

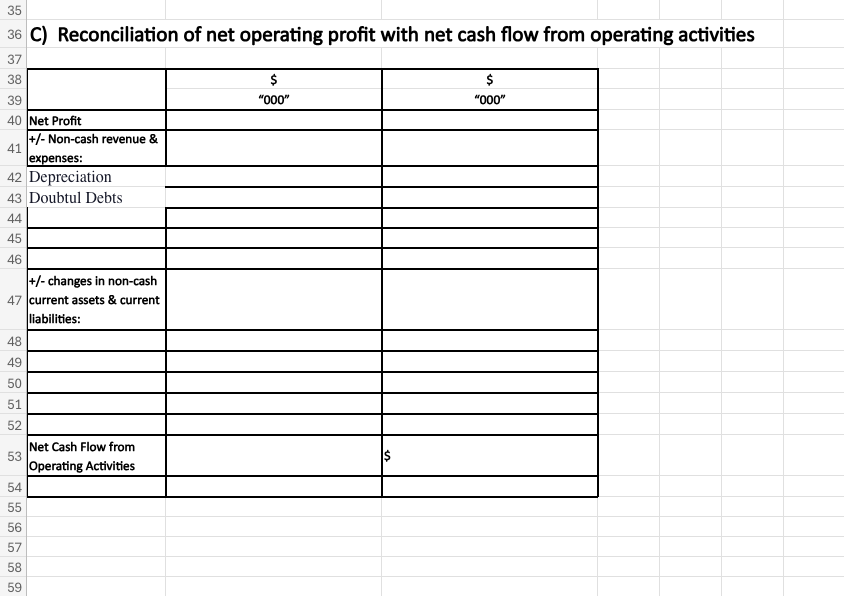

Question: Question 4 You are required to complete the below reports in line with Accounting standard AASB 107 Statement of cash flow and organisational policy and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts