Question: Question 4 You examine the current US Treasury yield curve and notice the following data points: 3-month yields = 0.2% 6-month yields = 0.1% 12-month

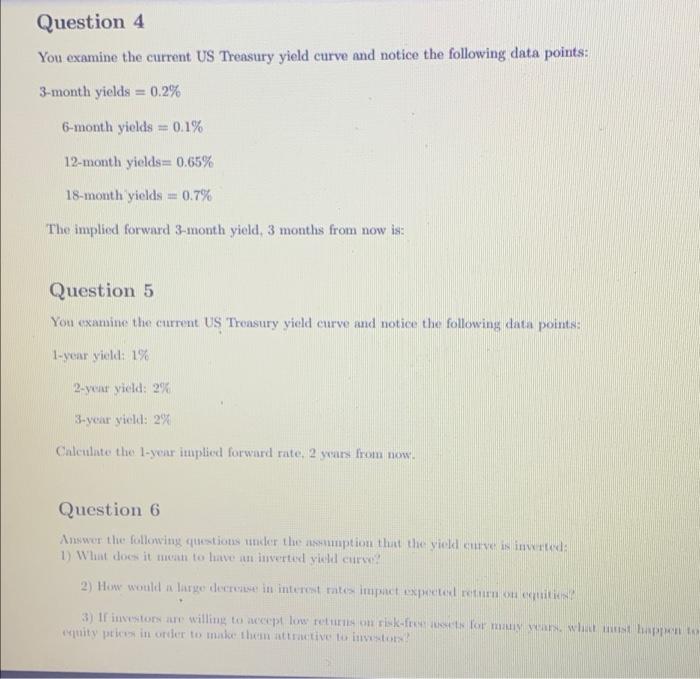

Question 4 You examine the current US Treasury yield curve and notice the following data points: 3-month yields = 0.2% 6-month yields = 0.1% 12-month yields= 0.65% 18-month yields 0.7% The implied forward 3-month yield, 3 months from now is: Question 5 You examine the current US Treasury vield curve and notice the following data points: 1-year yield: 1% 2-yent yield: 2% 3-year yield: 2% Calculate the l-year implied forward rate, 2 years from now. Question 6 Answer the following questions under the sumption that the yield curve is intend 1) What does it mean to live in inverted yield cure 2) How would no largo decrease in interest rate impact expected return ou equities 3) ir investors are willing to accept low returns on rikets for many year, white hapet uity price in order to make them attractive to investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts