Question: Question 40 1 pts Diversification is one way to reduce risk in a portfolio. You are managing a portfolio with a limited number of investments

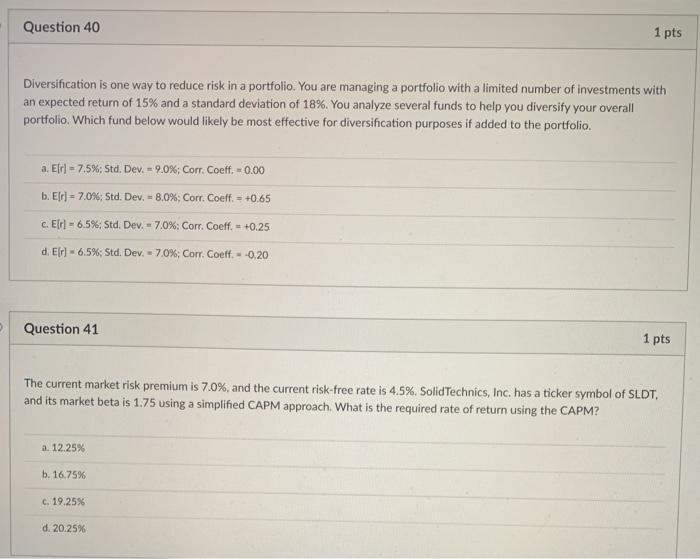

Question 40 1 pts Diversification is one way to reduce risk in a portfolio. You are managing a portfolio with a limited number of investments with an expected return of 15% and a standard deviation of 18%. You analyze several funds to help you diversify your overall portfolio. Which fund below would likely be most effective for diversification purposes if added to the portfolio a. Elr) 7.5%; Std. Dev. = 9.0%: Corr. Coeff. -0.00 b. Elr] - 7.0%; Std. Dev. = 8.0%: Corr. Coeff. = +0.65 c. Erl - 6.5%: Std. Dev. - 7.0%: Corr. Coeff. - +0.25 d. Elrl - 6.5%; Std. Dev. - 7.0%Corr. Coeff. - -0.20 Question 41 1 pts The current market risk premium is 7.0%, and the current risk-free rate is 4.5% Solid Technics, Inc. has a ticker symbol of SLDT, and its market beta is 1.75 using a simplified CAPM approach. What is the required rate of return using the CAPM? a. 12.25% b. 16.75% c. 19.25% d. 20.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts