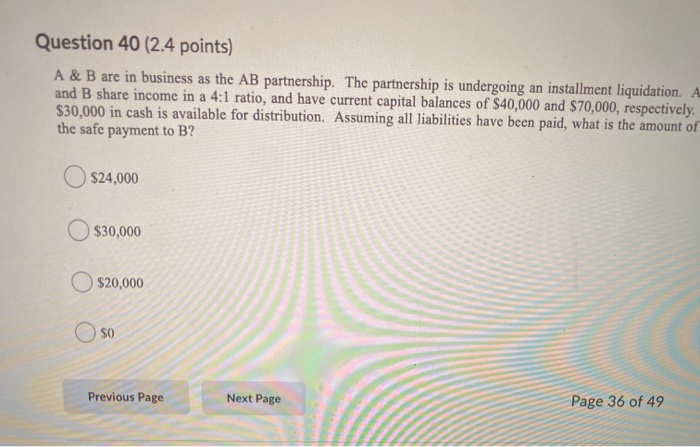

Question: Question 40 (2.4 points) A & B are in business as the AB partnership. The partnership is undergoing an installment liquidation. A and B share

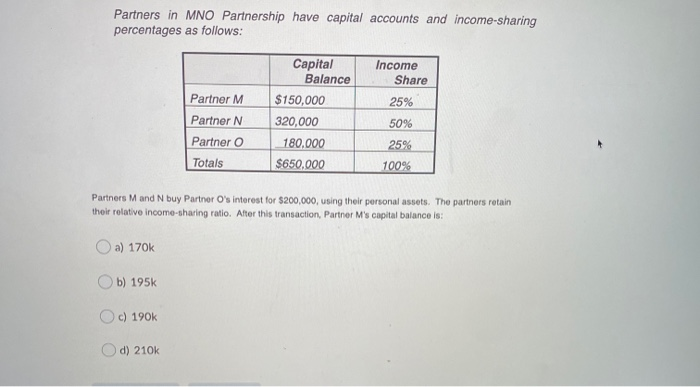

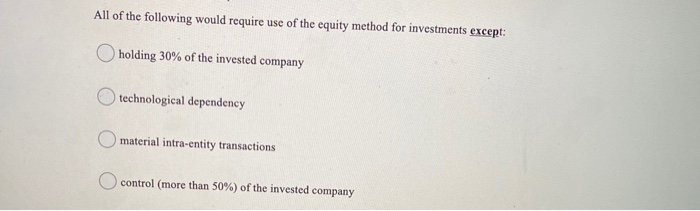

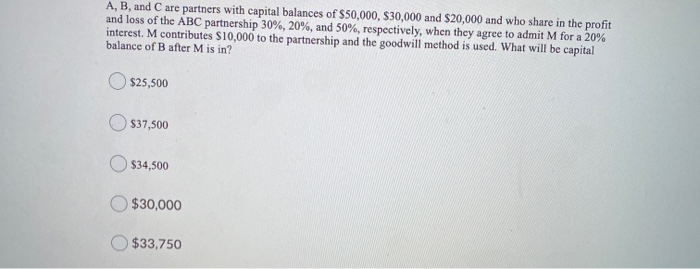

Question 40 (2.4 points) A & B are in business as the AB partnership. The partnership is undergoing an installment liquidation. A and B share income in a 4:1 ratio, and have current capital balances of $40,000 and $70,000, respectively. $30,000 in cash is available for distribution. Assuming all liabilities have been paid, what is the amount of the safe payment to B? $24,000 $30,000 $20,000 SO Previous Page Next Page Page 36 of 49 Partners in MNO Partnership have capital accounts and income-sharing percentages as follows: Income Share Partner M 25% Capital Balance $150,000 320,000 180.000 $650,000 Partner N Partner o Totals 50% 25% 100% Partners M and N buy Partner O's interest for $200,000, using their personal assets. The partners retain their relative income-sharing ratio. After this transaction, Partner M's capital balance is: a) 170k b) 195k c) 190k d) 210k All of the following would require use of the equity method for investments except: holding 30% of the invested company technological dependency material intra-entity transactions control (more than 50%) of the invested company A, B, and C are partners with capital balances of $50,000, $30,000 and $20,000 and who share in the profit and loss of the ABC partnership 30%, 20%, and 50%, respectively, when they agree to admit M for a 20% interest. M contributes $10,000 to the partnership and the goodwill method is used. What will be capital balance of B after M is in? $25,500 $37,500 $34,500 $30,000 $33,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts