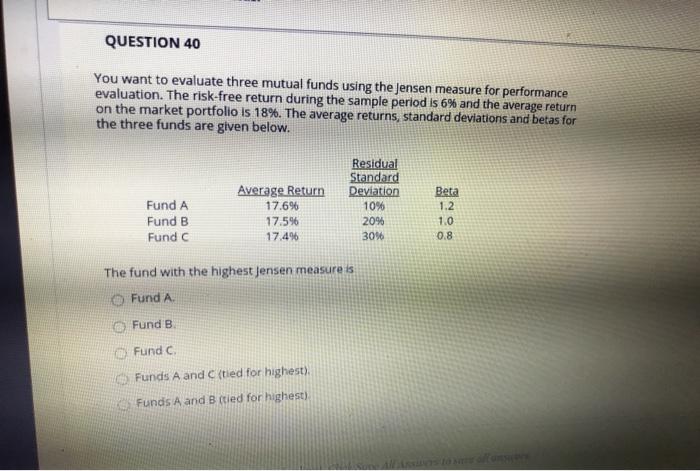

Question: QUESTION 40 You want to evaluate three mutual funds using the Jensen measure for performance evaluation. The risk-free return during the sample period is 6%

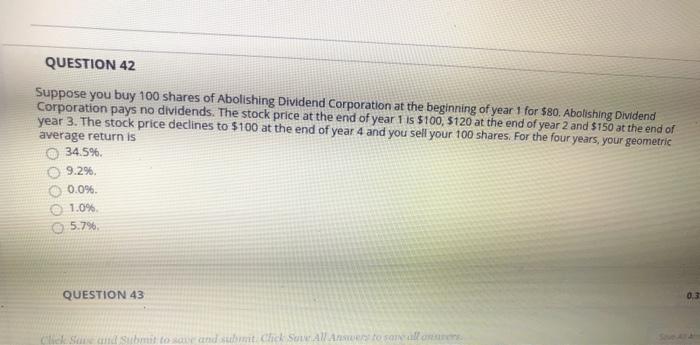

QUESTION 40 You want to evaluate three mutual funds using the Jensen measure for performance evaluation. The risk-free return during the sample period is 6% and the average return on the market portfolio Is 18%. The average returns, standard deviations and betas for the three funds are given below. Fund A Fund B Fund Average Return 17.6% 17.5% 17.496 Residual Standard Deviation 10% 20% 30% Beta 1.2 1.0 0.8 The fund with the highest Jensen measure is Fund A Fund B Fund c Funds A and tied for highest), Funds A and B (tied for highest) store QUESTION 42 Suppose you buy 100 shares of Abolishing Dividend Corporation at the beginning of year 1 for $80. Abolishing Dividend Corporation pays no dividends. The stock price at the end of year 1 is $100, 5120 at the end of year 2 and $150 at the end of year 3. The stock price declines to $100 at the end of year 4 and you sell your 100 shares. For the four years, your geometric average return is 34.5%. 9.29. 0.0% 1.0% 5.796 QUESTION 43 0,3 Click Save and Submit tour and sucht Chek SAWA to someone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts